Demo video: Vietnam - VAT Counterpart Account

Key Feature

- This module is an extension of the to_vat_counterpart module according to Vietnam Standards.

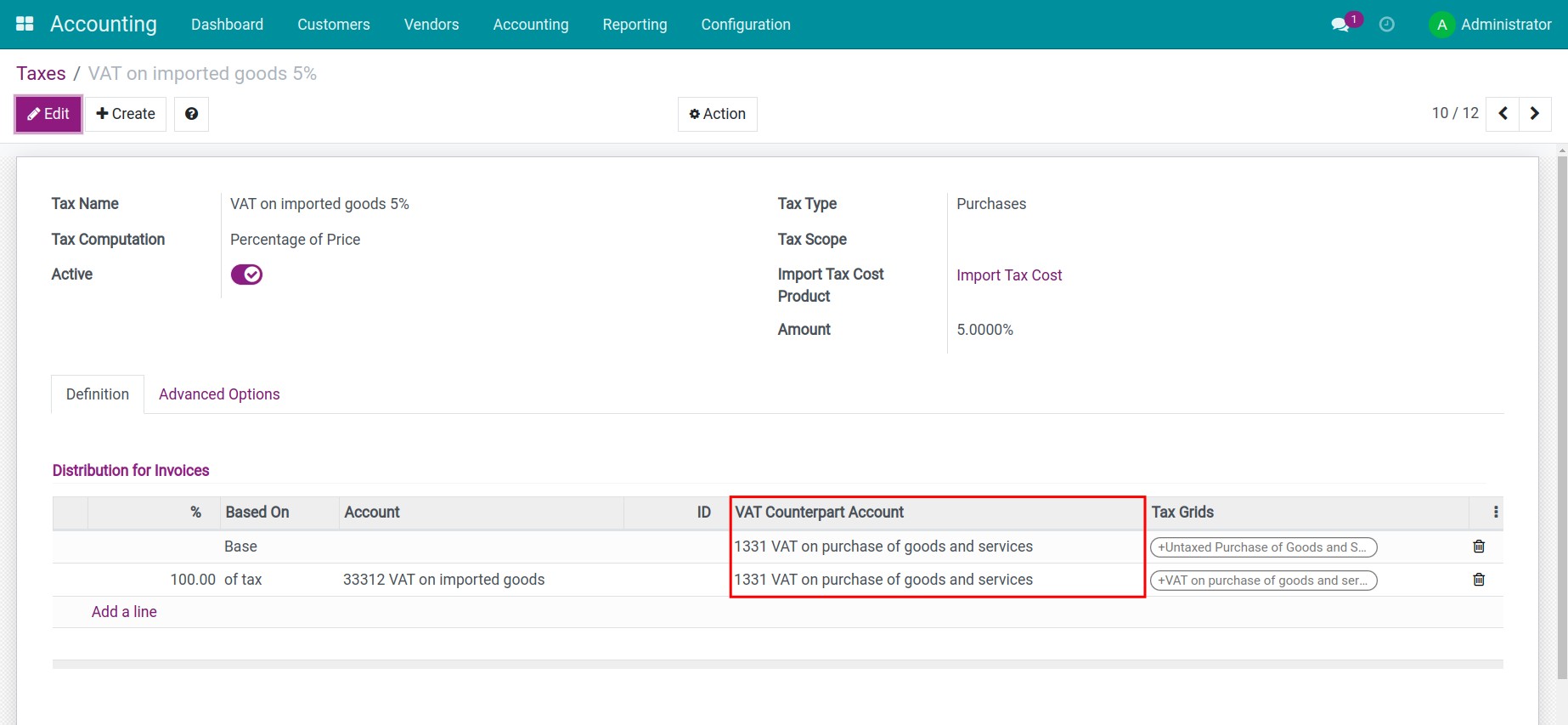

- This module will automatically fill in account 1331- VAT on purchase of goods and services in the column VAT Counterpart Account on the interface of VAT on imported goods that administration software presets.

Editions Supported

- Community Edition

- Enterprise Edition

Installation

- Navigate to Apps.

- Search with keyword l10n_vn_viin_vat_counterpart.

- Press Install.

When you install this module, the following application will be automatically installed: Invoicing.

Auto fill Vietnam - VAT Counterpart Account

Instruction video: Vietnam - VAT Counterpart Account

This module automatically fills account 1331 - VAT on purchase of goods and services in the column VAT Counterpart Account on the interface of VAT on imported goods types pre-set by the software. This will help the software automatically numb the accounting by recording the amount of VAT on imported goods to be deducted when you import goods.

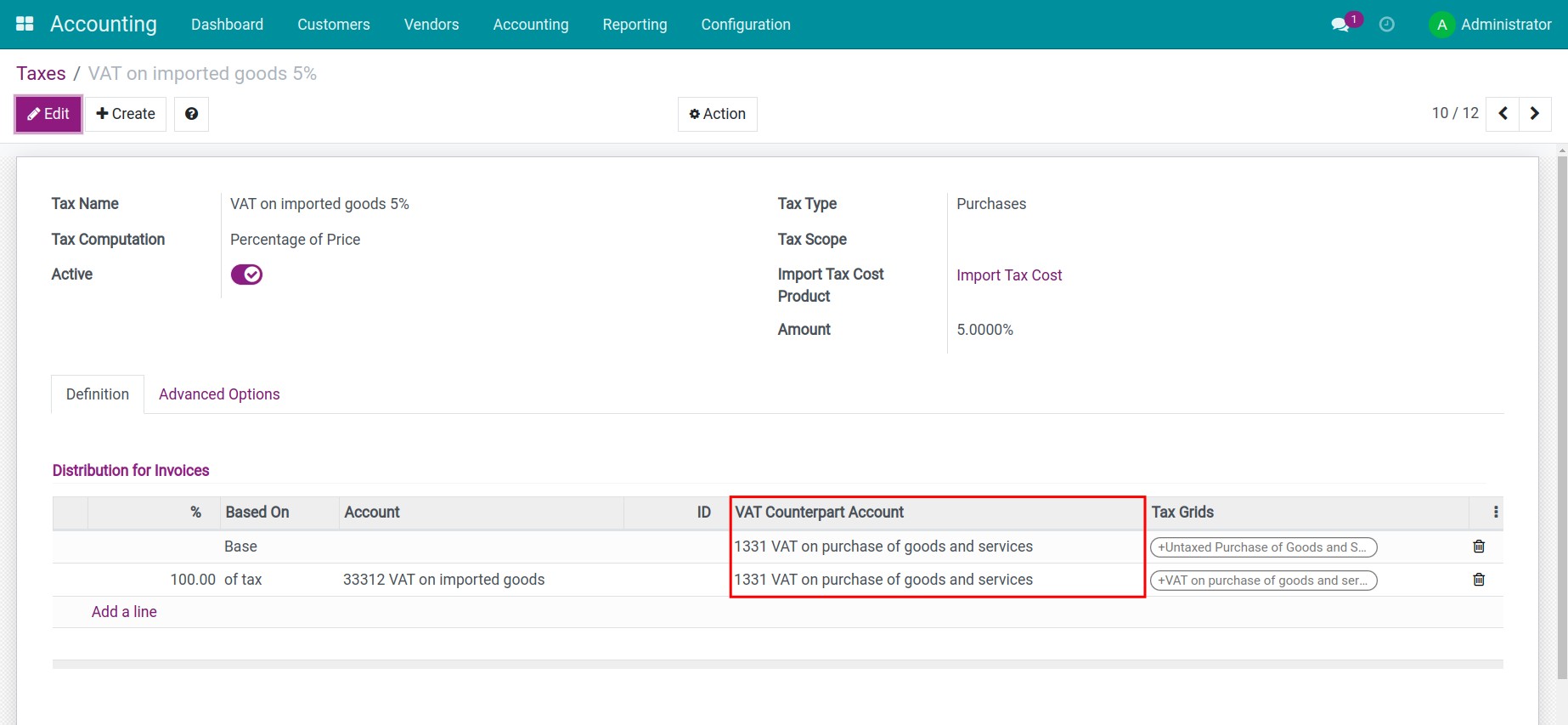

Check Settings

After installing this module, you access the application Accounting > Configuration > Taxes. You can choose any pre-set VAT on imported goods. The account 1331 - VAT on purchase of goods and services was filled in by default in the column VAT Counterpart Account.

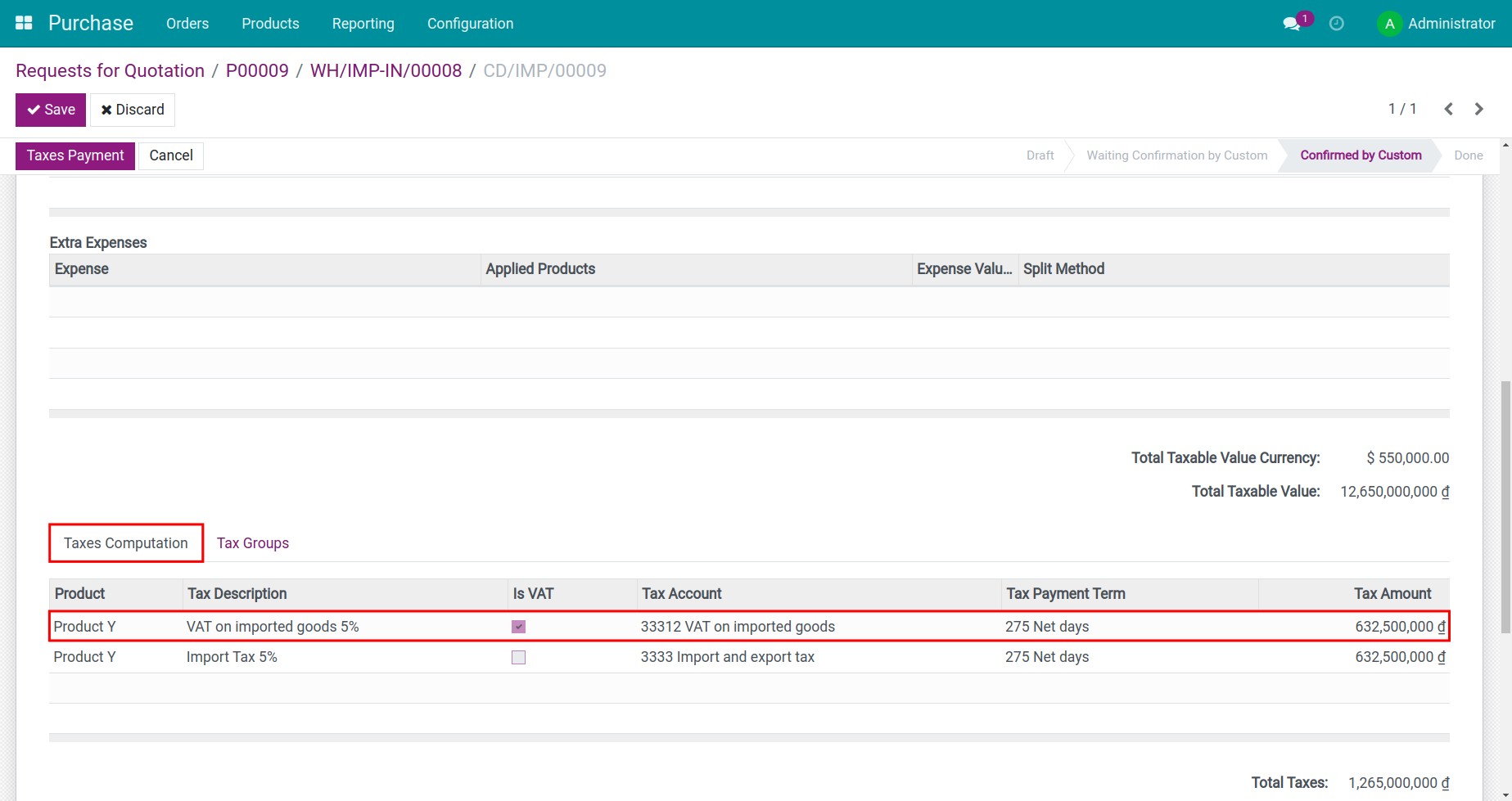

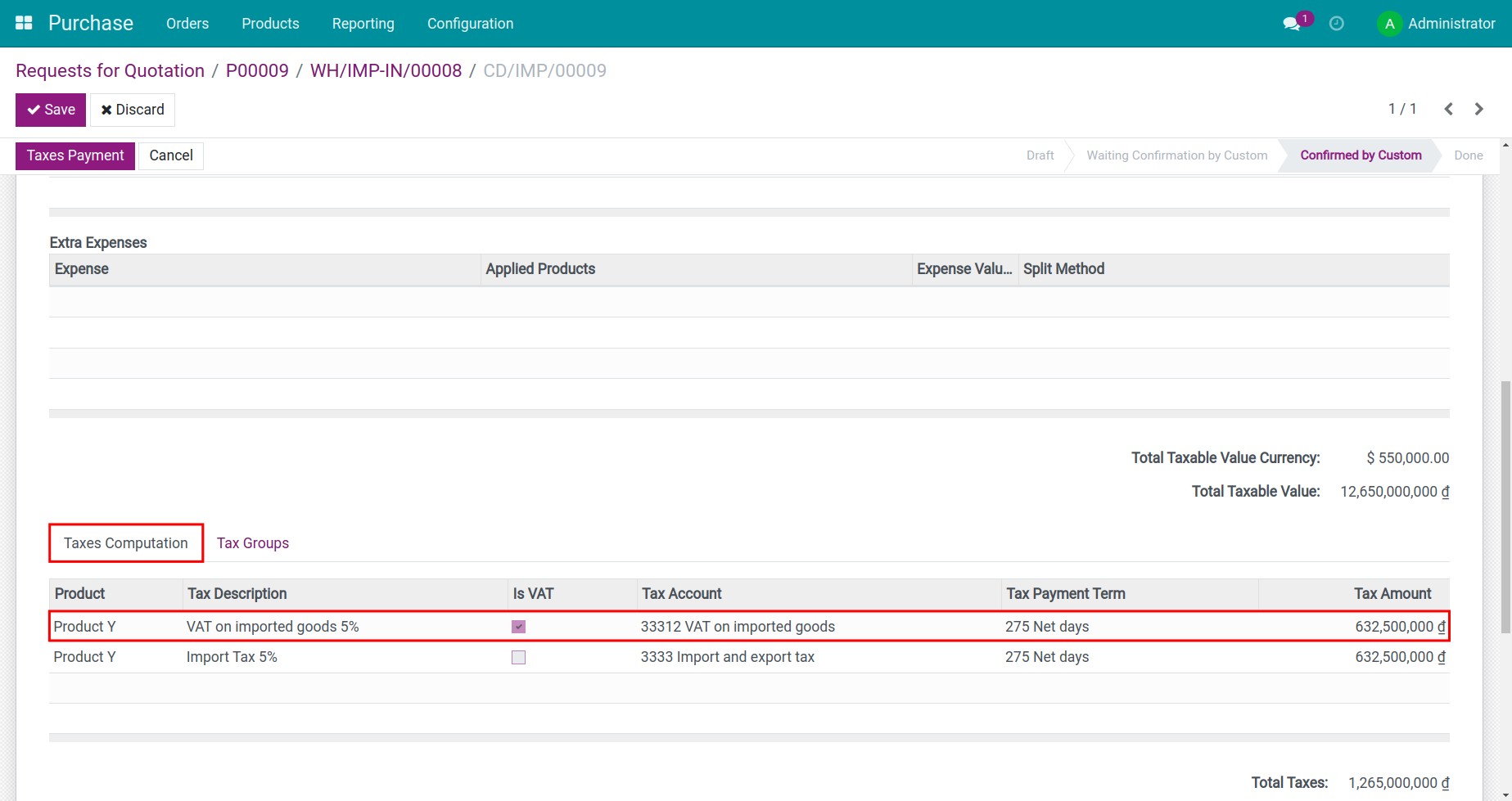

Usage

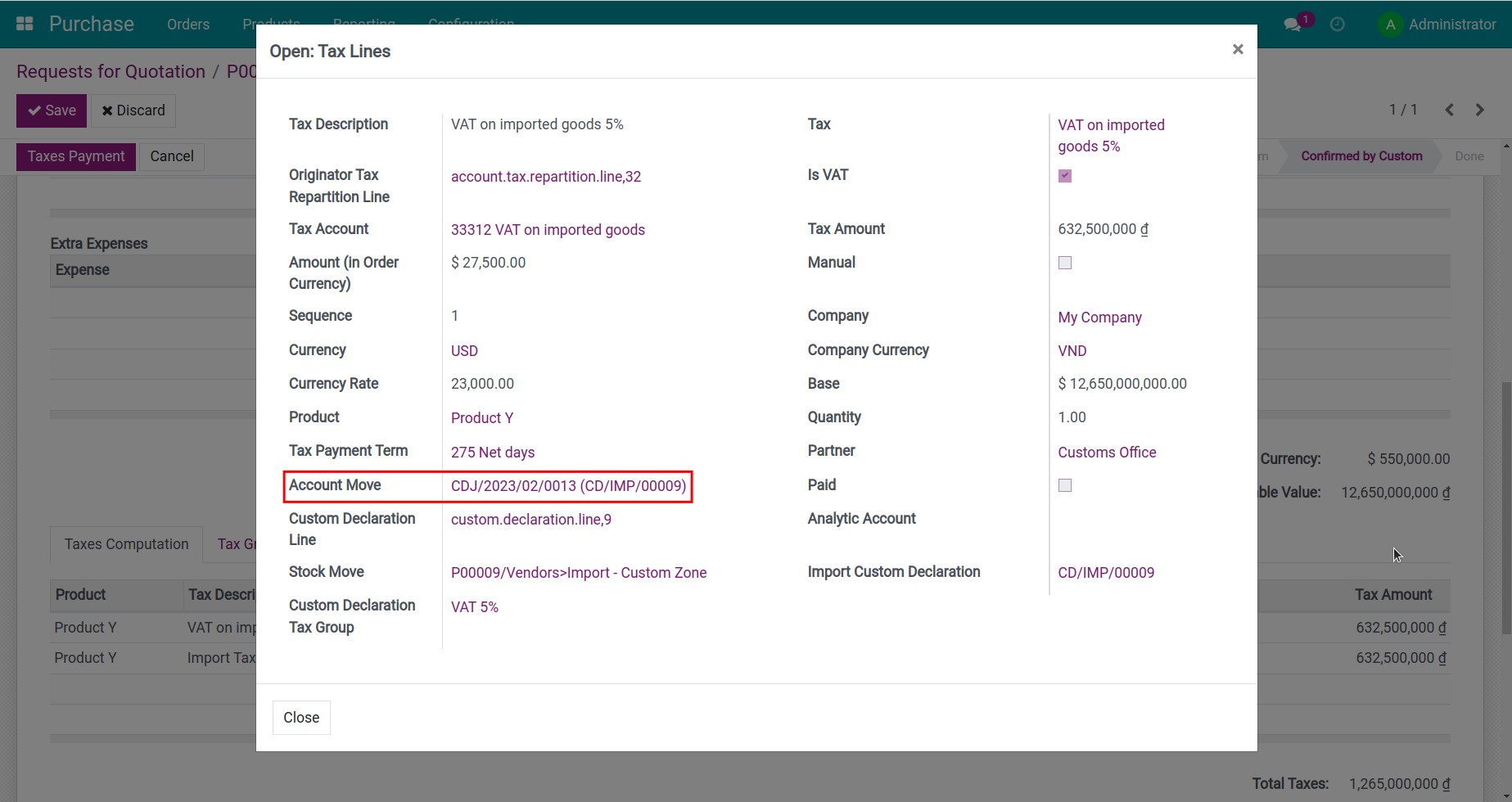

You perform steps to import goods. After confirming the Import Customs Clearance Request, on the customs request, go to the Taxes Computation tab and click on the accounting line containing account 33312.

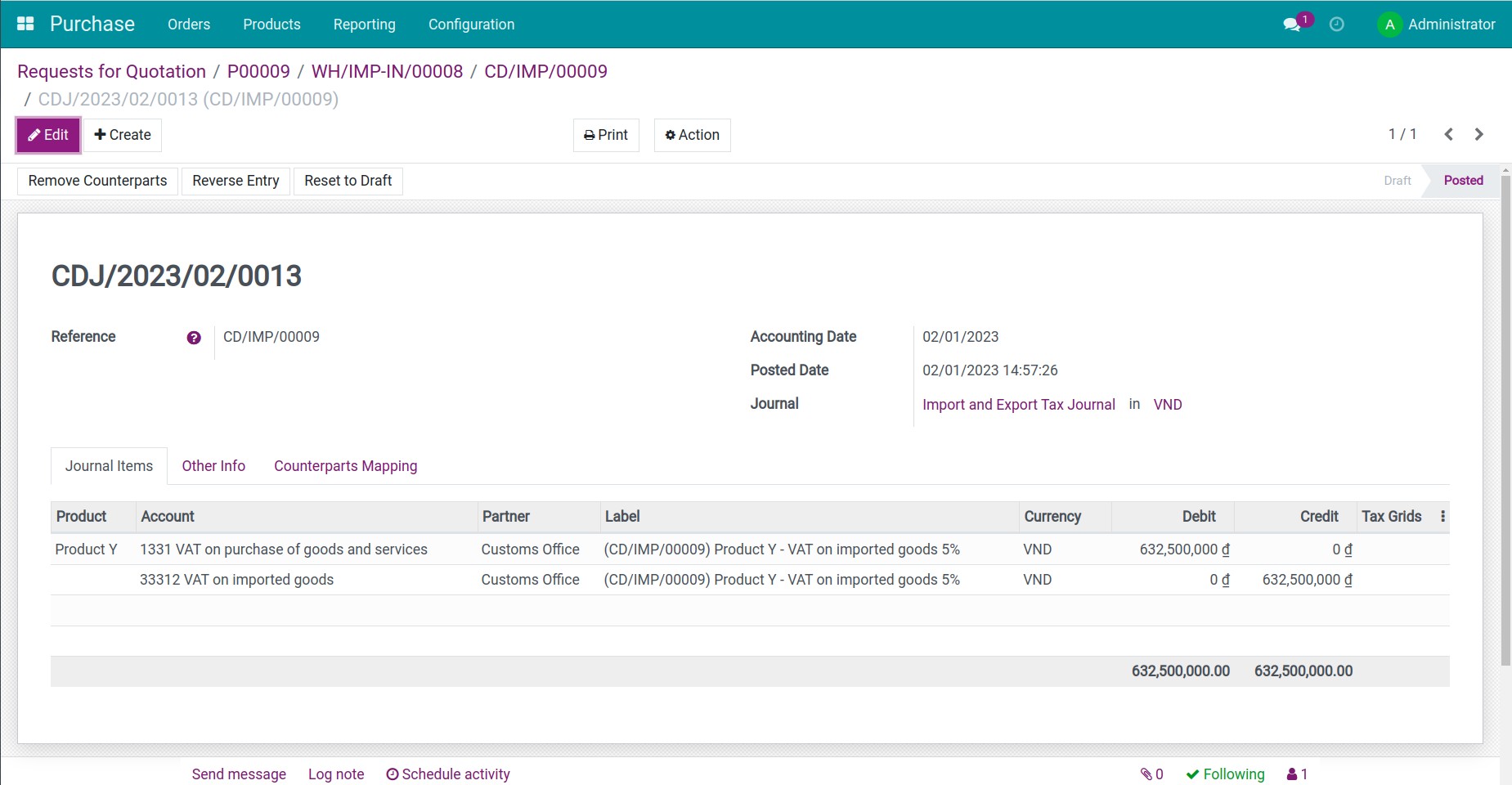

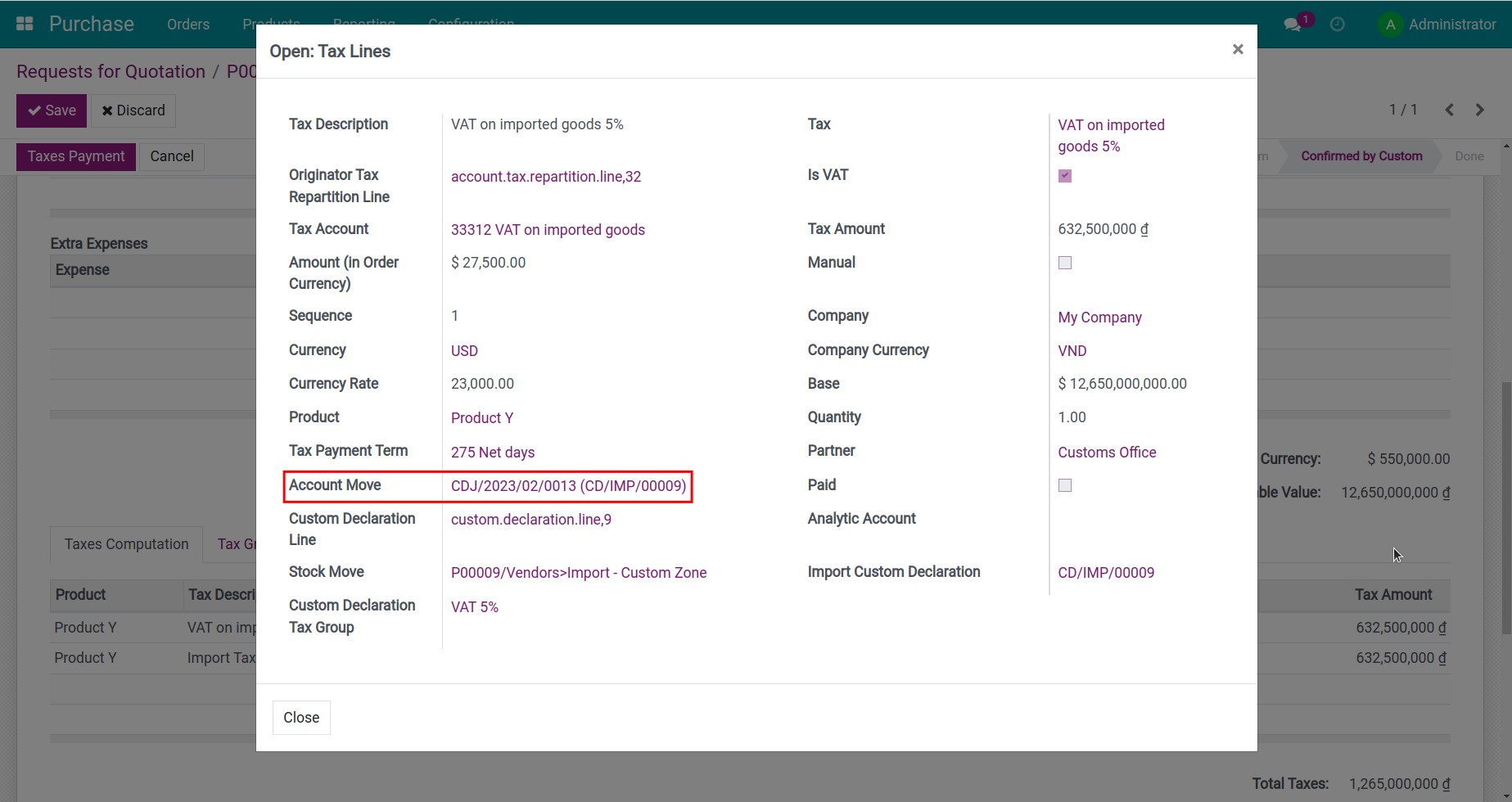

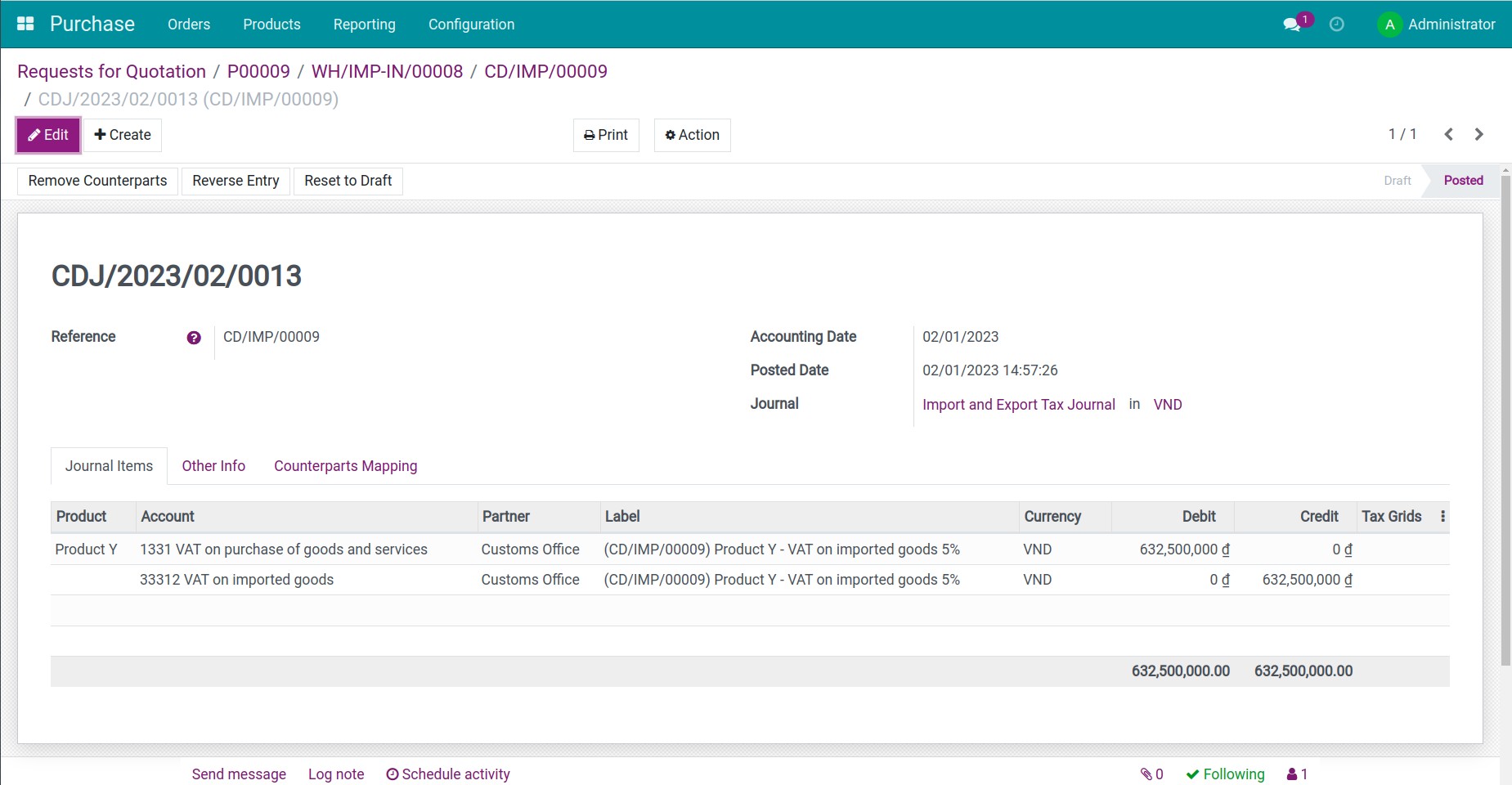

In the pop-up window, click on the journal entry in the Account Move field.

Here, you will see the journal entry generated by the software to record the deductible VAT on imported goods.

This software and associated files (the "Software") may only be

used

(executed, modified, executed after modifications) if you have

purchased a

valid license from the authors, typically via Odoo Apps,

or if you

have

received a written agreement from the authors of the

Software (see the

COPYRIGHT file).

You may develop Odoo modules that use the Software as a library

(typically

by depending on it, importing it and using its

resources), but

without

copying any source code or material from the

Software. You may distribute

those modules under the license of your

choice, provided that this

license

is compatible with the terms of

the Odoo Proprietary License (For

example:

LGPL, MIT, or proprietary

licenses similar to this one).

It is forbidden to publish, distribute, sublicense, or sell

copies of the

Software or modified copies of the Software.

The above copyright notice and this permission notice must be

included in

all copies or substantial portions of the Software.

THE SOFTWARE IS PROVIDED "AS IS", WITHOUT WARRANTY OF ANY KIND,

EXPRESS OR

IMPLIED, INCLUDING BUT NOT LIMITED TO THE WARRANTIES OF

MERCHANTABILITY,

FITNESS FOR A PARTICULAR PURPOSE AND

NONINFRINGEMENT. IN NO EVENT

SHALL THE

AUTHORS OR COPYRIGHT HOLDERS

BE LIABLE FOR ANY CLAIM, DAMAGES OR OTHER

LIABILITY, WHETHER IN AN

ACTION OF CONTRACT, TORT OR OTHERWISE,

ARISING

FROM, OUT OF OR IN

CONNECTION WITH THE SOFTWARE OR THE USE OR OTHER

DEALINGS IN THE

SOFTWARE.