Demo video: Refund Accounts

In business activities, situations such as sales transactions, returned goods, or incorrect invoices requiring adjustments occur frequently.

Accountants must record separately revenue from sales, revenue adjustments due to incorrect invoices, and revenue reductions from returned goods.

This ensures accurate revenue recognition and revenue deductions for the period, providing management with a clear and precise view of the company's financial performance.

Key Features

- Provides Revenue Refund Account Setup

- Accountants can configure revenue and expense refund accounts either in the company's general settings or for specific product groups or individual products.

- These settings are unique to each company.

- Revenue and Expense Refund Features

- When recording a transaction for returned goods, the system recognizes the revenue or expense reduction and posts it to the designated refund accounts.

- If no specific refund account is set up, the system defaults to the refund accounts on the original invoice.

Business Value

- Helps accountants avoid errors in revenue reductions and returned goods transactions.

- Provides management with a clear and accurate view of business performance.

Who Should Use This Module?

This module is essential for every business, regardless of size or industry.

Situations such as returned goods or invoice adjustments are inevitable in daily operations, and accurately handling these transactions helps maintain financial transparency and operational efficiency.

With its automation and process optimization, this module not only reduces errors but also boosts productivity in the accounting department, ensuring accurate revenue and expense records.

Supported Editions

- Community Edition

- Enterprise Edition

Installation

- Navigate to Apps.

- Search with keyword to_refund_account.

- Press Install.

How to use

Instruction video: Refund Accounts

1. Set up refund account on product/product category

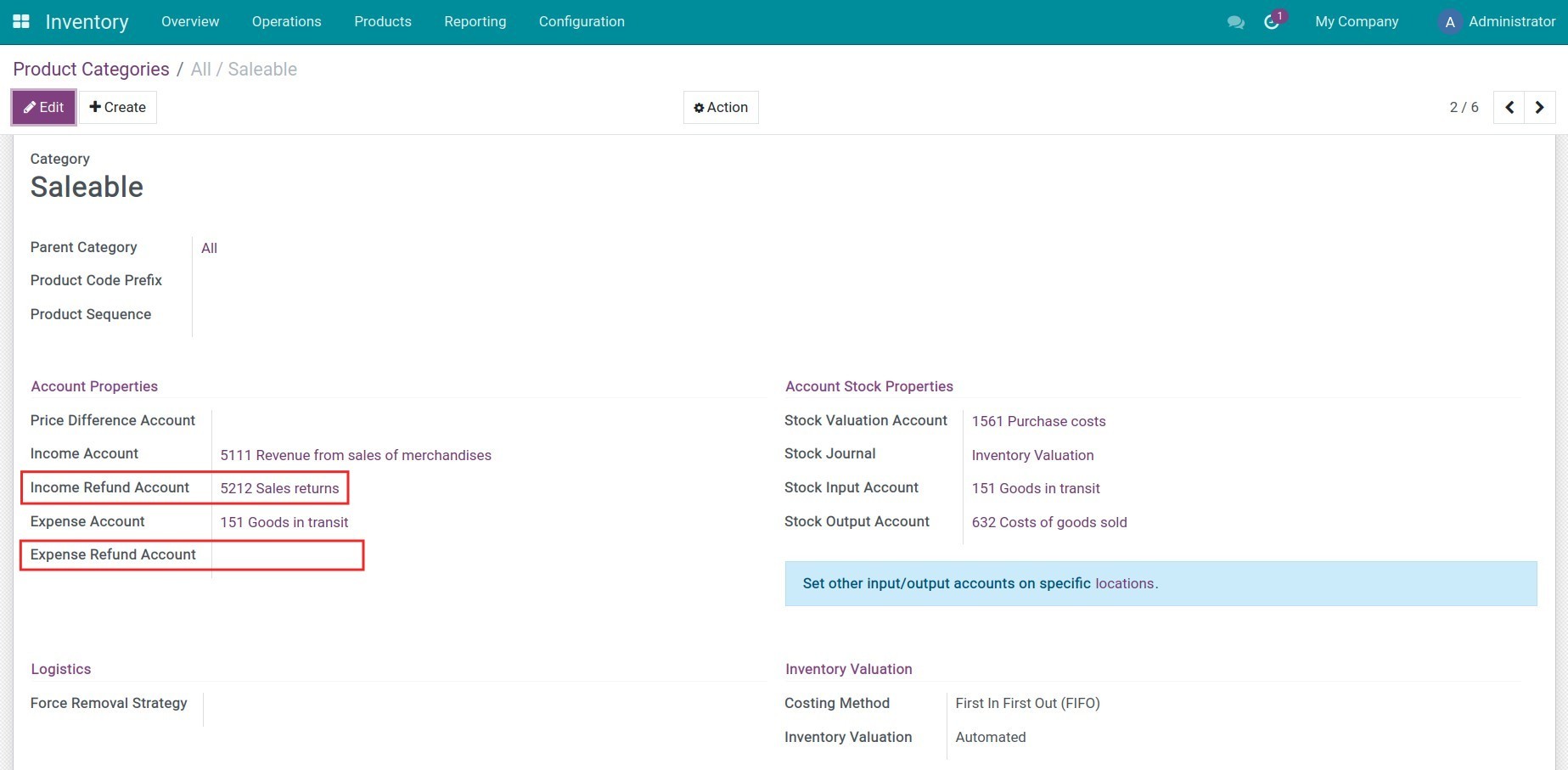

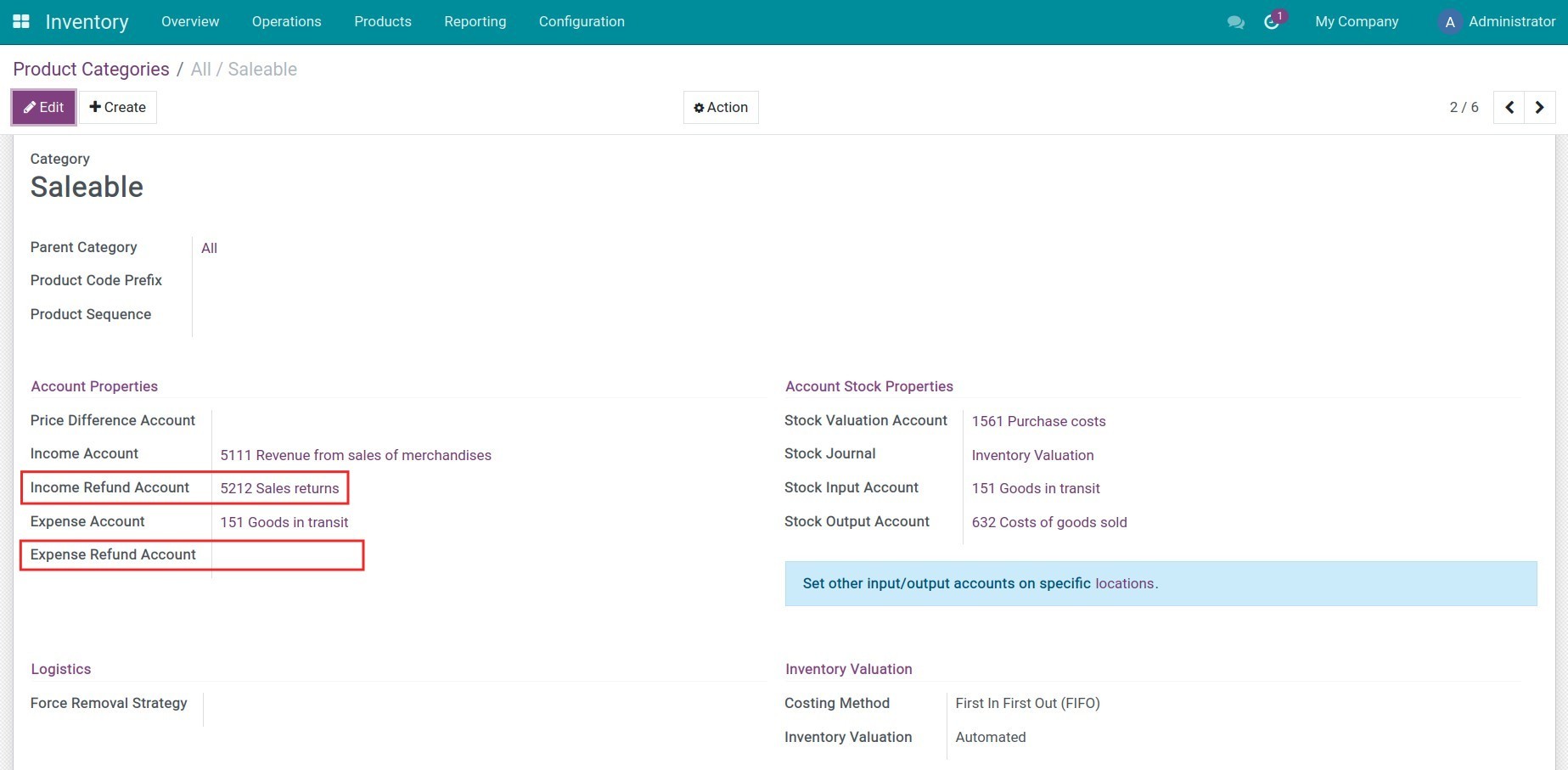

Product category can be accessed from many different places in the system such as Inventory, Purchase, etc. On the product category view, enter the accounts that record the revert entries for the income and expend account.

Press Save to save the information.

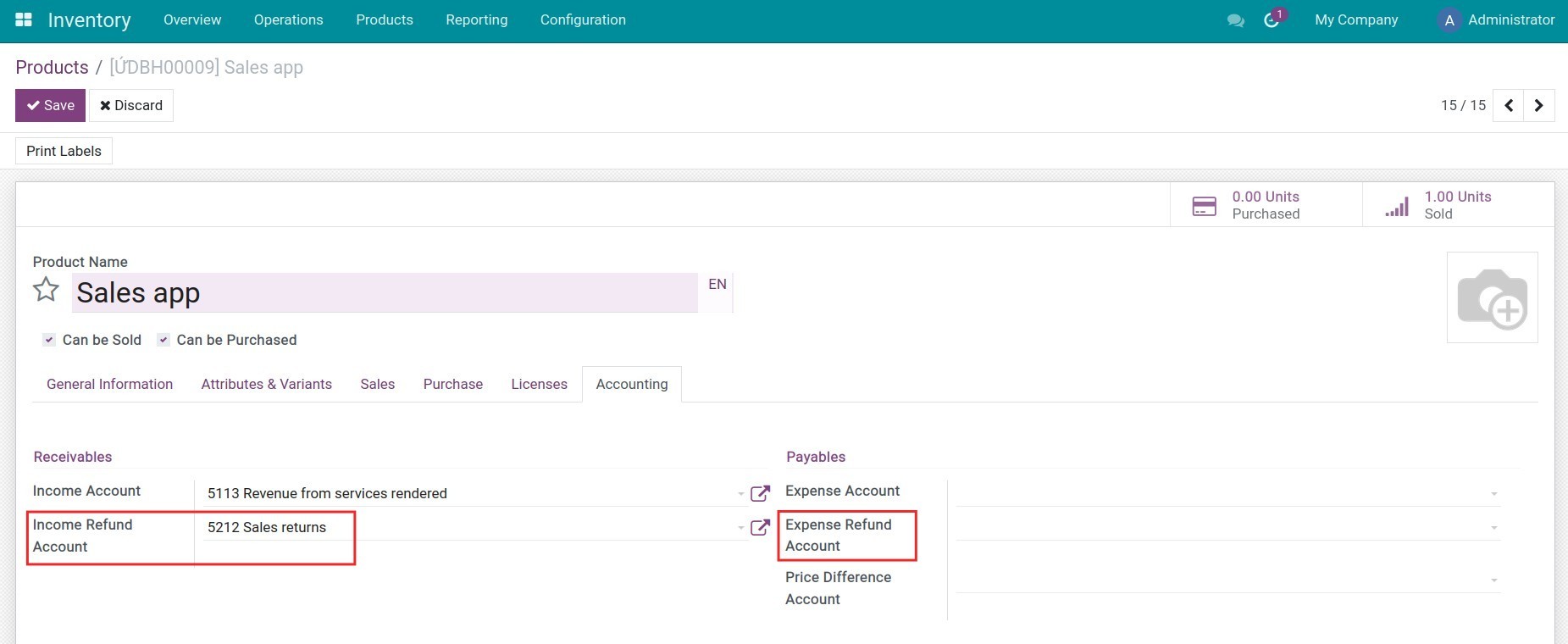

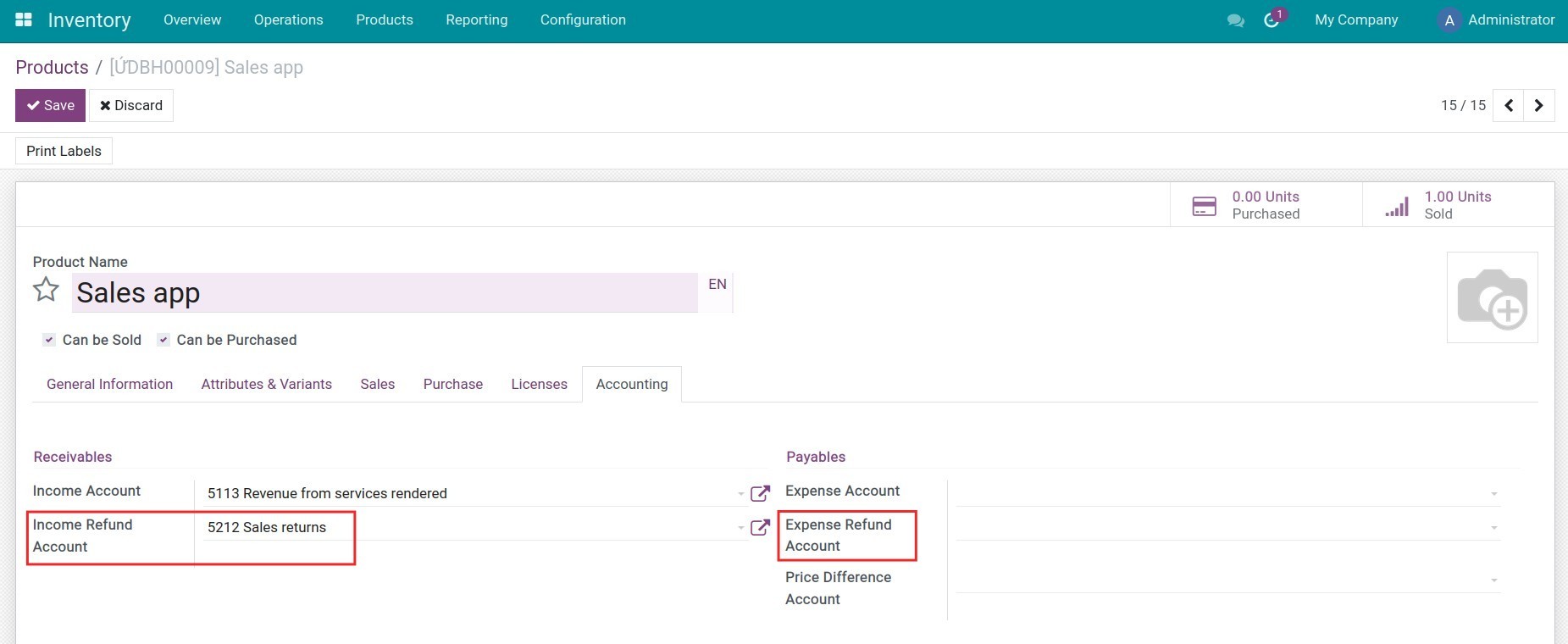

Instead of using accounting accounts on product categories, some products will have their own way of recording entries. Viindoo Accounting app allows you to set up income, expense, or refund accounts on each product by navigating to Inventory > Products > Products.

2. Create refund invoices

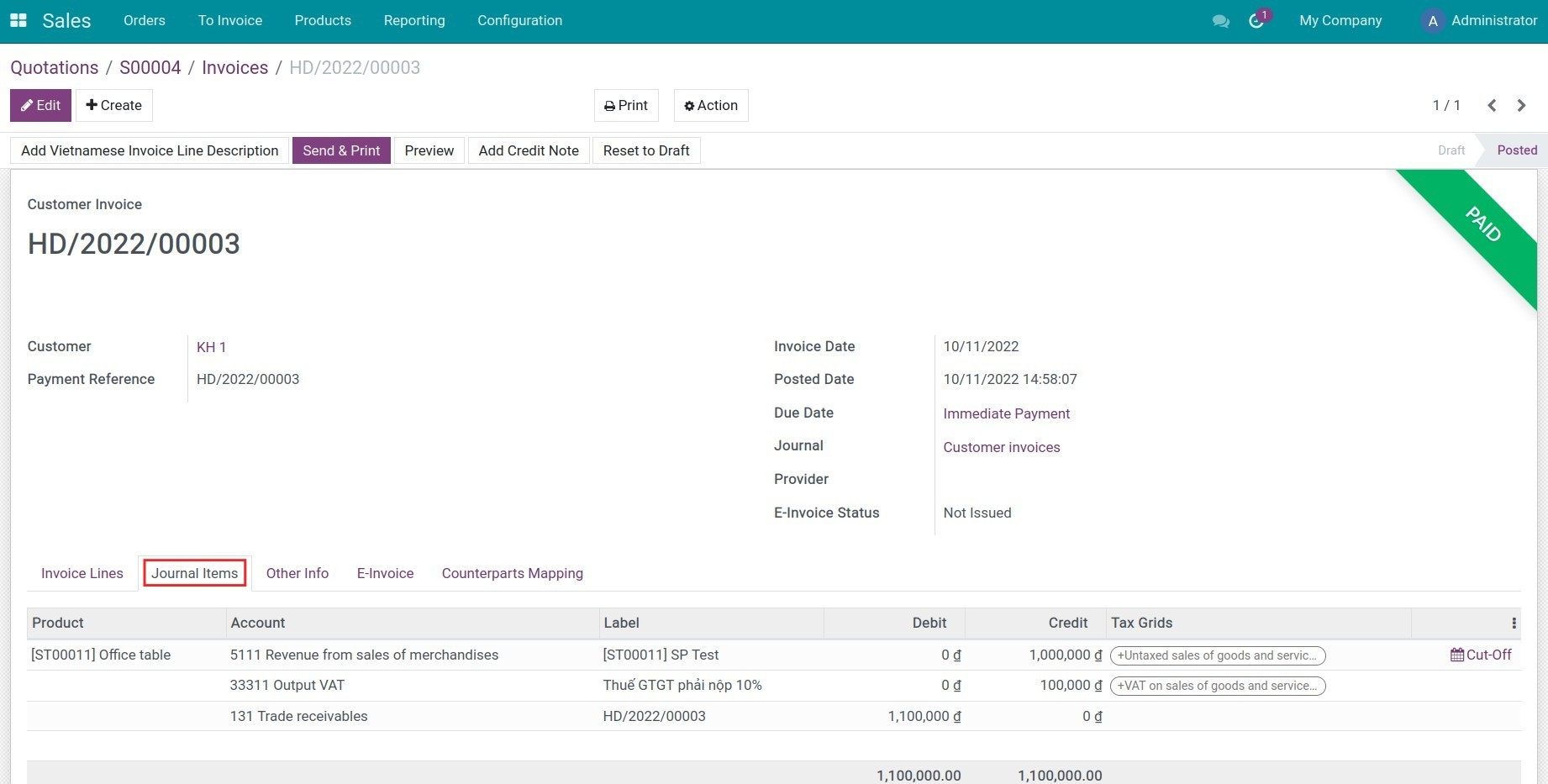

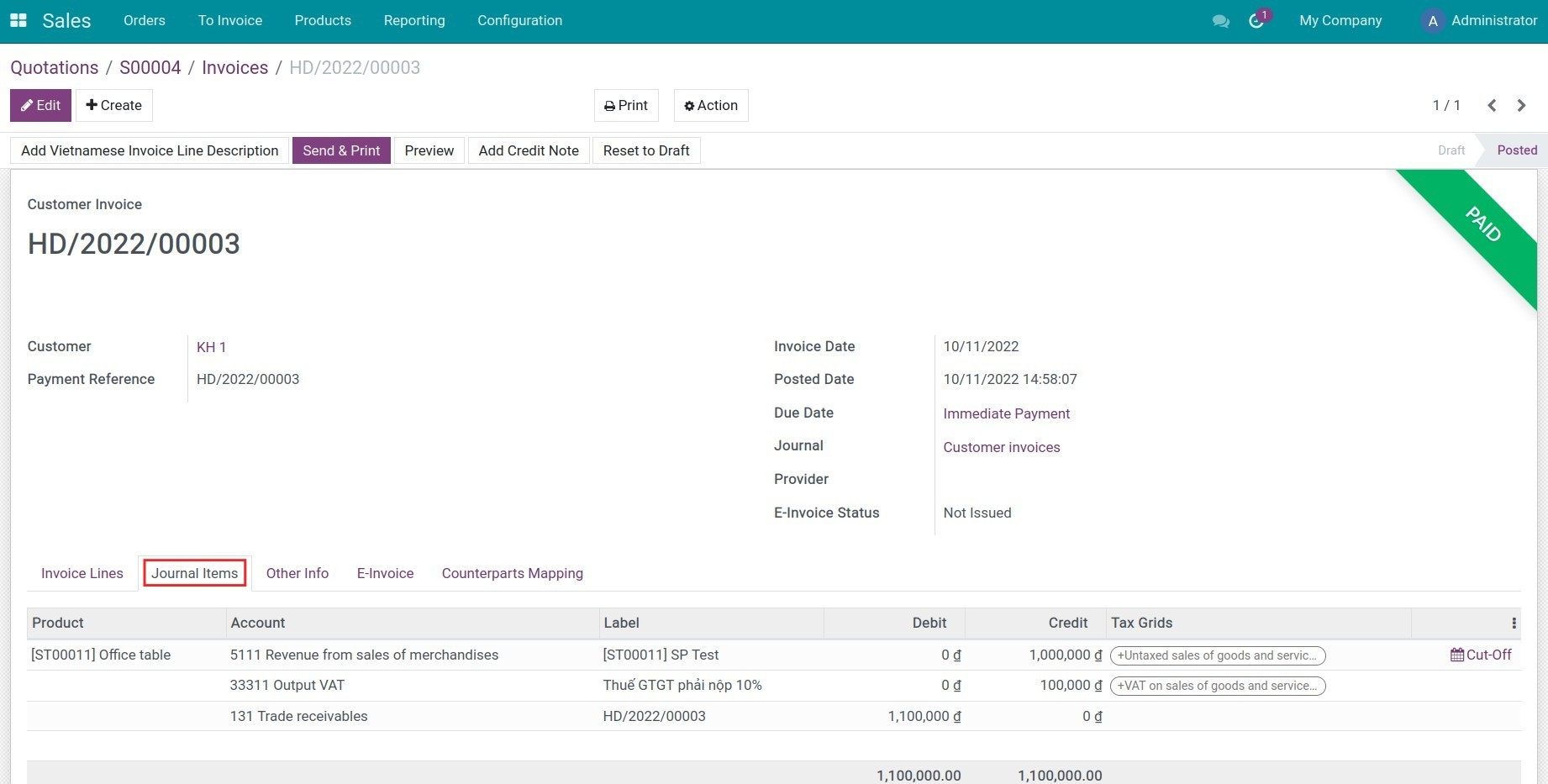

Start with creating a sales order and then create customer invoice. On the invoice, the system will generate the following journal items:

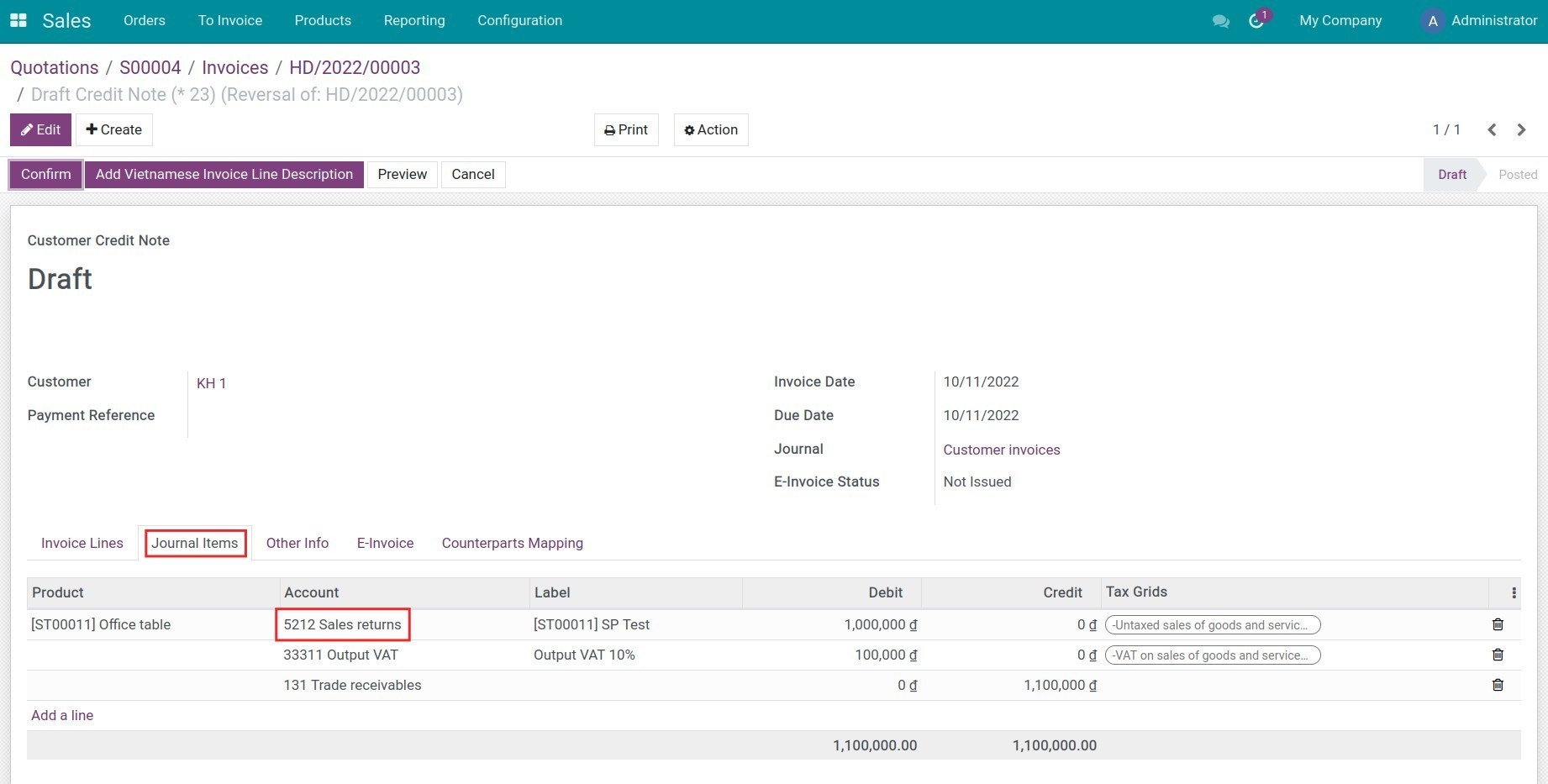

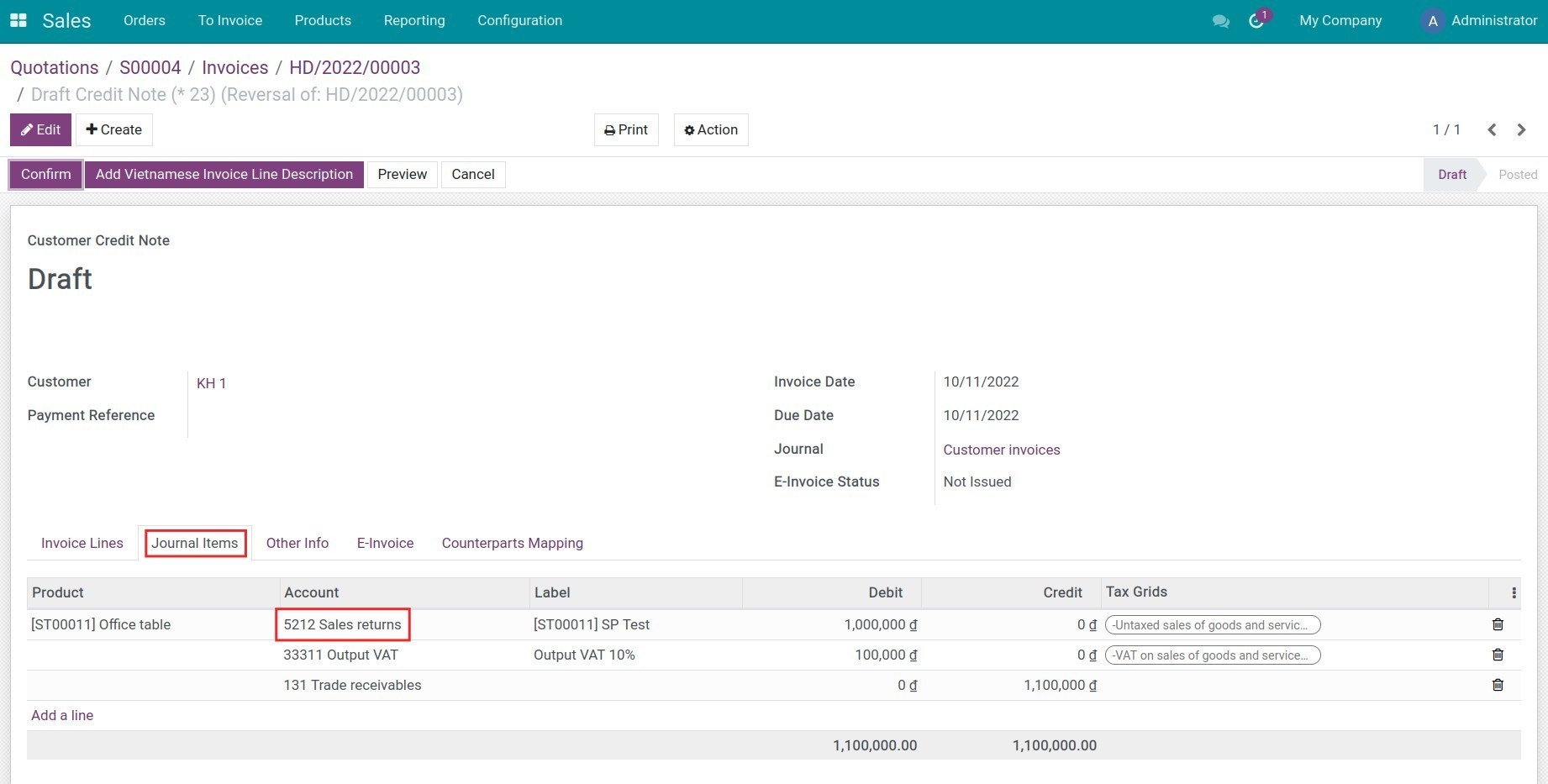

But since the customer wants to refund the goods, you need to create a credit note The credit note will auto-select the income refund account that you have set on the product or product category.

Repeat similar steps for the vendor bills with the expense refund account.

This software and associated files (the "Software") may only be

used

(executed, modified, executed after modifications) if you have

purchased a

valid license from the authors, typically via Odoo Apps,

or if you

have

received a written agreement from the authors of the

Software (see the

COPYRIGHT file).

You may develop Odoo modules that use the Software as a library

(typically

by depending on it, importing it and using its

resources), but

without

copying any source code or material from the

Software. You may distribute

those modules under the license of your

choice, provided that this

license

is compatible with the terms of

the Odoo Proprietary License (For

example:

LGPL, MIT, or proprietary

licenses similar to this one).

It is forbidden to publish, distribute, sublicense, or sell

copies of the

Software or modified copies of the Software.

The above copyright notice and this permission notice must be

included in

all copies or substantial portions of the Software.

THE SOFTWARE IS PROVIDED "AS IS", WITHOUT WARRANTY OF ANY KIND,

EXPRESS OR

IMPLIED, INCLUDING BUT NOT LIMITED TO THE WARRANTIES OF

MERCHANTABILITY,

FITNESS FOR A PARTICULAR PURPOSE AND

NONINFRINGEMENT. IN NO EVENT

SHALL THE

AUTHORS OR COPYRIGHT HOLDERS

BE LIABLE FOR ANY CLAIM, DAMAGES OR OTHER

LIABILITY, WHETHER IN AN

ACTION OF CONTRACT, TORT OR OTHERWISE,

ARISING

FROM, OUT OF OR IN

CONNECTION WITH THE SOFTWARE OR THE USE OR OTHER

DEALINGS IN THE

SOFTWARE.