Profit and Loss Statement is an important financial statement that helps businesses monitor the financial situation of the company. The preparation of this report is crucial for businesses to make informed decisions about investment and finance activities. In this article, together with Viindoo, let's explore the definitions of "What is a profit and loss report" and the latest internal monthly profit and loss report templates.

What is profit and loss statement?

The profit and loss report (P/L) is a report that shows the revenue, expenses, and profit/loss from the business operations of a company over a specific period of time. Simply put, with this report, businesses will know whether they are making a profit or a loss.

So, is it important and why do businesses need it?

The P/L statement is crucial to provide managers, investors, and other stakeholders with an overview of the financial situation of the company over a specific period of time. Besides, this report also has other specific benefits such as:

Assessing business operation effectiveness: The report allows businesses to measure the effectiveness of their business operations over a specific period, typically a quarter or a financial year.

Supporting investment decisions: The report provides information on the financial performance of the company, helping investors decide whether to invest in the company or not.

Providing in-depth insights: The report provides an overall picture of the company's revenue and expenses trends, thereby helping management make informed decisions about resource allocation and profit improvement in the future.

>>>> Learn more: 10+ finance statement template according Circular 133, 200

How to prepare a monthly profit and loss report?

Step 1: Prepare records, documents, files

To prepare the report quickly and accurately, businesses need to prepare all necessary documents, account receivable statement,... during the business operation, sales, product promotion, etc.

Businesses should store and organize documents by time, function, etc., to easily search and use when necessary..

Tired of manually update revenue reports? Automate it now!

- Real-time update when sales order confirmed, payment completed, etc. without any delays

- Automate data entry, processing, visualization in charts

- Fully tracking of cash flow trends, forecast revenues, growth opportunities

Step 2: Determine the report period

Next, businesses need to determine the period for preparing the report. This period could be a month, a quarter, or a financial year, depending on the monitoring needs of each company.

Step 3: Gather information

In step 3, businesses need to gather information about the revenue and expenses of the company during the monitoring period, including:

- Revenue: The total amount received from business operations, including sales revenue, service provision fees.

- Opportunity costs: Costs not directly related to business operations, including non-inventory costs, labor costs such as rent, advertising costs, etc.

- Selling expenses: Expenses incurred when the business sells products or provides services, including delivery costs, maintenance costs, insurance costs, etc.

- Financial expenses: Expenses related to finance and banking, including interest rates, bank fees, costs arising from borrowing money.

- Other expenses: Other expenses related to the business operations of the company, including warehouse maintenance costs, insurance costs, utility costs, employee training costs, etc.

Step 4: Calculate and analyze profit and loss

Calculate the revenue, profit, or loss of the business during that period by subtracting expenses from revenue.

Additionally, businesses can determine net income, "after-tax income" of the company.

Conducting profit and loss analysis to better understand the factors affecting business operation effectiveness.

Step 5: Create a report

Create a report with the information gathered and calculated above.

You can use the profit and loss report templates below to make the process faster and easier.

Now, let's move on to the next part!

P&L statement

Difference between the balance sheet and the P/L statement

Transaction timing: The balance sheet shows the financial position of a company at a specific point in time, while the P&L shows the financial performance of a company over a period, typically a financial year.

Nature of accounts: Accounts in the balance sheet are related to assets, liabilities, and equity, while P&L accounts are related to revenue and expenses.

Focus on the past vs. the future: The balance sheet provides an overview of the company's financial position at a specific point in time, showing past transactions. In contrast, the P&L focuses on the future by predicting expected revenue and expenses over a specific period.

Interconnected financial statements: Although the balance sheet and the profit and loss report are separate financial statements, they are interconnected. Net income or loss from the P&L is transferred to the equity section of the balance sheet, affecting the company's financial position.

Tired of manually update revenue reports? Automate it now!

- Real-time update when sales order confirmed, payment completed, etc. without any delays

- Automate data entry, processing, visualization in charts

- Fully tracking of cash flow trends, forecast revenues, growth opportunities

Balance sheet vs. profit and loss statement

Profit and loss statement template

Internal profit and loss statement

This report is used to evaluate the financial situation of a company at a specific point in time.

This report includes information on revenue, expenses, profit, and loss.

Download this report template HERE.

Internal P&L statement

Internal P&L statementMonthly and annual profit and loss statement

This P/L template helps businesses easily track business and financial situations by quarter.

This will ensure that business activities are managed and controlled according to plan.

Let's refer to and use this template!

Download the Excel file profit and loss report HERE.

Monthly P&L statement

Monthly P&L statementTired of manually update revenue reports? Automate it now!

- Real-time update when sales order confirmed, payment completed, etc. without any delays

- Automate data entry, processing, visualization in charts

- Fully tracking of cash flow trends, forecast revenues, growth opportunities

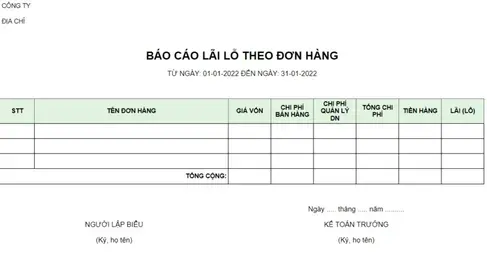

Profit and loss report statement by sales order

The profit and loss, cost report by sales order helps businesses accurately determine the profit or loss from a single sales order.

Download this template HERE.

Mẫu báo cáo P/L theo đơn bán hàng

Mẫu báo cáo P/L theo đơn bán hàngHow Accounting software can help automate making P&L report?

Instead of manually searching for templates and updating disorganized data, you can automate the process with accounting software. Viindoo Accounting Software will be great selection, which can greatly assist in preparing Profit and Loss (P&L) reports in several ways:

Automated Data Entry: Accounting software automates the process of recording financial transactions, including revenue, expenses, and other income. By automatically capturing this data from various sources such as invoices, bank statements, and receipts, it reduces the manual effort required for data entry and ensures accuracy.

Real-Time Data Updates: Accounting software provides real-time updates to financial data, allowing for up-to-date P&L reports at any given time. This ensures that decision-makers have access to the most current financial information, facilitating timely decision-making.

Categorization and Classification: Accounting software categorizes transactions into relevant accounts based on predefined chart of accounts. This categorization ensures that revenue and expenses are properly classified, making it easier to generate accurate P&L reports.

Customization: Most accounting software allows users to customize P&L reports according to their specific needs. Users can choose the time period, select which accounts to include or exclude, and apply filters to analyze specific aspects of the business. This flexibility allows for tailored reporting to meet the requirements of different stakeholders.

Comparative Analysis: Accounting software enables comparative analysis by providing tools to compare P&L reports across different time periods. Users can easily compare current performance with previous periods to identify trends, assess financial health, and make informed decisions.

Integration with Other Systems: Many accounting software systems integrate with other business systems such as inventory management, sales, and payroll. This integration ensures that all relevant financial data is captured and reflected accurately in the P&L report, providing a comprehensive view of the organization's financial performance.

Forecasting and Budgeting: Advanced accounting software may include features for financial forecasting and budgeting. By leveraging historical data and trends, users can create forecasts and budgets, which can be compared against actual performance in the P&L report to assess variances and make necessary adjustments.

Discover Viindoo Accounting Software

Automate process of preparing P&L statement, improves accuracy, provides timely insights, and facilitates informed decision-making to drive business success.

FAQs

How to classify Financial Reports: Profit and Loss Statement

Profit and Loss (P&L) statement is considered one of the most crucial financial reports, illustrating a business's earnings and expenditures over a specific period, whether monthly, quarterly, or annually.

How is the balance sheet related to the Profit and Loss statement?

Balance sheet and Profit and Loss statement:

- Balance sheet: Describes the financial position of a business at a specific point in time.

- Profit and Loss statement, or Income statement: Indicates the financial performance over a specific period.

Which is more important, the balance sheet or the profit and loss statement?

Both are essential tools in a company's financial management. However, the balance sheet allows for an overall assessment of the financial situation and utilizes that information to make business decisions. On the other hand, the profit and loss statement only indicates the company's business results over a specific period. Therefore, the balance sheet is more critical for evaluating the company's financial condition.

In the article, Viindoo provided definitions of what a profit and loss report is and the most common profit and loss report templates available today. We hope this information is helpful for businesses. Follow Viindoo for more useful articles!

>>>> See more: