If you are looking for an easy-to-use software solution that can help you calculate the FIFO inventory costing method, then Viindoo is the perfect tool for you. With Viindoo software, businesses of all sizes can streamline their inventory management processes and make better business decisions.

In this article, we will provide a comprehensive guide on how to use Viindoo software to calculate the FIFO inventory costing method. We will cover everything from the basics of FIFO inventory costing to the benefits of using Viindoo software for your inventory management needs.

>>>> Find Out About: Warehouse and inventory management software

Understanding the Basics of FIFO Inventory Costing Method

Before we dive into how to use Viindoo software to calculate the FIFO inventory costing method , let's first understand the basics of FIFO inventory costing.

FIFO is an inventory valuation method that assumes the oldest items in a company's inventory are sold first, while the newest items remain unsold. This means that the cost of goods sold (COGS) is based on the cost of the oldest items, while the ending inventory value is based on the cost of the newest items.

For example, suppose you run a grocery store, and you sell apples. You have the following transactions:

On Day 1, you purchase 100 apples at $1 each. (Total cost: $100)

On Day 3, you purchase 50 more apples at $1.10 each. (Total cost: $55)

On Day 5, you sell 120 apples.

Using the FIFO method, you would assume that the first 100 apples from Day 1 are sold, followed by 20 from the second batch on Day 3. Here's the breakdown:

Day 1 apples (100 x $1) = $100

Day 3 apples (20 x $1.10) = $22

Total cost of goods sold (COGS) = $100 + $22 = $122

This method ensures that the cost of the first batch of apples is applied to the goods sold before the cost of the second batch.

Understanding the Basics of FIFO Inventory Costing

>>>> Read About: How to Use Specific Identification Method for Inventory

How to Use Viindoo Software to Calculate the FIFO Inventory Costing Method

Now that we have a basic understanding of FIFO inventory costing, let's take a look at how to use Viindoo software to calculate this method.

Viindoo Inventory Cost Method Software

15 DAYS FREE TRIAL

Improves the efficiency of inventory & supply chain management, and intensifies competitiveness of enterprises.

Step 1: Configuration of Product Categories

Log in to your Viindoo account and go to the Inventory app.

Create or edit the product categories you want to apply FIFO to.

Configuration FIFO Inventory Costing Method on Product Categories Viindoo

Configuration FIFO Inventory Costing Method on Product Categories ViindooStep 2: Configuration of Products

For product form, configure the General Information tab as follow:

- Product Type: Storable Product;

- Product Category: All/Saleable.

Configuration FIFO Inventory Costing Method on Product Viindoo

Configuration FIFO Inventory Costing Method on Product ViindooStep 3: Make Sales or Deliveries:

When you make a sale or deliver products, Viindoo will automatically calculate the cost of goods sold (COGS) using the FIFO method.

Create sale order products with the FIFO inventory costing method Viindoo

Step 4: Monitor Inventory Valuation

Generate reports - With Viindoo software, you can easily generate reports that show your FIFO inventory costing calculations. This allows you to make informed business decisions and see the financial impact of your inventory management practices.

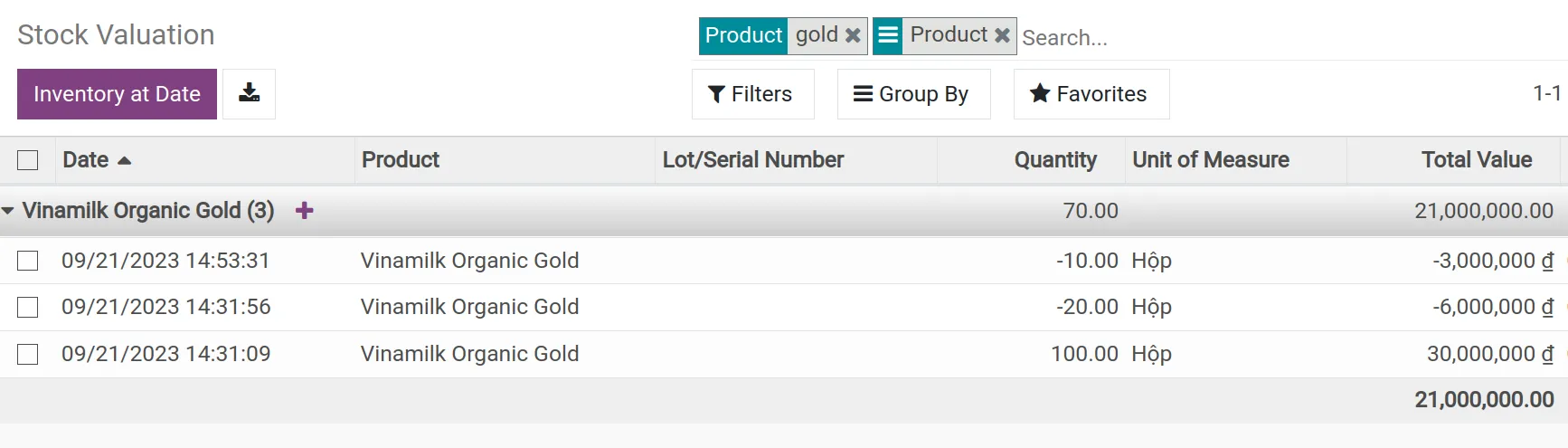

You can monitor the FIFO valuation by generating reports.

Go to Reporting > Inventory > Inventory Valuation.

Select the appropriate options to view FIFO-based valuations.

View Inventory Valuation reports

Manage your inventory - As you purchase new inventory items and sell existing ones, Viindoo software will automatically track all of your inventory movements, costs, and quantities. This ensures that your COGS and ending inventory values are always accurate based on the FIFO method.

Inventory valuation with FIFO inventory costing method Viindoo

>>>> See More: How the inventory valuation works in Viindoo

Comparisons with Other Inventory Costing Methods

While the FIFO method is popular among businesses of all sizes, there are other inventory costing methods to consider. Let's take a look at some comparisons between FIFO and other inventory costing methods.

FIFO vs. LIFO

LIFO (Last In, First Out) is another common inventory valuation method that assumes the most recent items in a company's inventory are sold first. This means that the COGS is based on the cost of the newest items, while the ending inventory value is based on the oldest items.

The main difference between FIFO and LIFO is the order in which inventory costs are calculated. While FIFO assumes that the oldest items are sold first, LIFO assumes that the newest items are sold first. This can have a significant impact on a company's financial statements, particularly during times of rising or falling prices.

FIFO is generally more accurate for businesses with perishable or time-sensitive inventory items, while LIFO may be more beneficial for tax purposes or during times of inflation.

FIFO vs. Average Cost

Average cost is another inventory costing method that calculates the average cost of all items in a company's inventory to determine the COGS and ending inventory value.

The main difference between FIFO and average cost is the way that inventory costs are calculated. While FIFO uses the actual cost of each item, average cost calculates the average cost of all items in the inventory.

FIFO may be more accurate for businesses with fluctuating inventory costs or high-value items, while average cost may be more beneficial for businesses with steady inventory costs or low-value items.

>>>> See More: Understanding FEFO in Inventory Management How it Works

Advises for Using Viindoo Software for FIFO Inventory Costing

To ensure that you get the most out of using Viindoo import inventory software for FIFO inventory costing, here is some advice to keep in mind:

- Input all inventory information accurately - To ensure that your FIFO calculations are accurate, make sure to input all inventory information correctly, including costs, quantities, and purchase dates.

- Regularly update your inventory system - As you purchase new inventory items and sell existing ones, make sure to regularly update your inventory system to ensure that your FIFO calculations are always accurate.

- Generate reports regularly - By generating reports regularly, you can stay informed about your inventory management practices and make informed business decisions.

- Seek professional advice if needed - If you are unsure about how to use Viindoo software for FIFO inventory costing or have questions about your inventory management practices, consider seeking professional advice.

FAQs

How does Viindoo software calculate the cost of goods sold with FIFO?

Viindoo software uses the FIFO method to calculate the cost of goods sold by assuming that the oldest items in a company's inventory are sold first. This means that the COGS is based on the cost of the oldest items, while the ending inventory value is based on the cost of the newest items.

Is FIFO the best inventory costing method to use?

The best inventory costing method to use depends on the specific needs of your business. FIFO is generally more accurate for businesses with perishable or time-sensitive inventory items, while other methods like LIFO or average cost may be more beneficial for other types of businesses.

Can Viindoo software be used for other inventory costing methods besides FIFO?

Yes, Viindoo software can be used for other inventory costing methods besides FIFO, including LIFO and average cost.

Can I track the FIFO cost of each individual item in Viindoo?

Yes, Viindoo allows you to track the FIFO cost of each individual item in your inventory. This information can be viewed in the product's inventory valuation report.

Is Viindoo software easy to use for businesses of all sizes?

Yes, Viindoo software is designed to be user-friendly for businesses of all sizes, from small retail businesses to large manufacturing companies.

Conclusion

In conclusion, using Viindoo software to calculate the FIFO inventory costing method is an effective way to streamline your inventory management processes and make better business decisions. By understanding the basics of FIFO inventory costing, following our guide on how to use Viindoo software, and keeping our advice in mind, you can ensure that your FIFO calculations are accurate and up-to-date. Whether you are a small business owner or a large corporation, Viindoo software can help you manage your inventory more efficiently and accurately. By automating your FIFO inventory costing calculations and providing real-time insights into your inventory movements, Viindoo software saves you time, money, and resources.

If you are interested in using Viindoo software for your inventory management needs, be sure to take advantage of their free trial period and customer support services. With Viindoo software, you can take control of your inventory and make informed business decisions with confidence.

>>>> See More: