Demo video: HR Expense & Payroll Integration

Key Features

The module provides additional features:

- Allow employees to propose reimbursement for their expenses on the payslips.

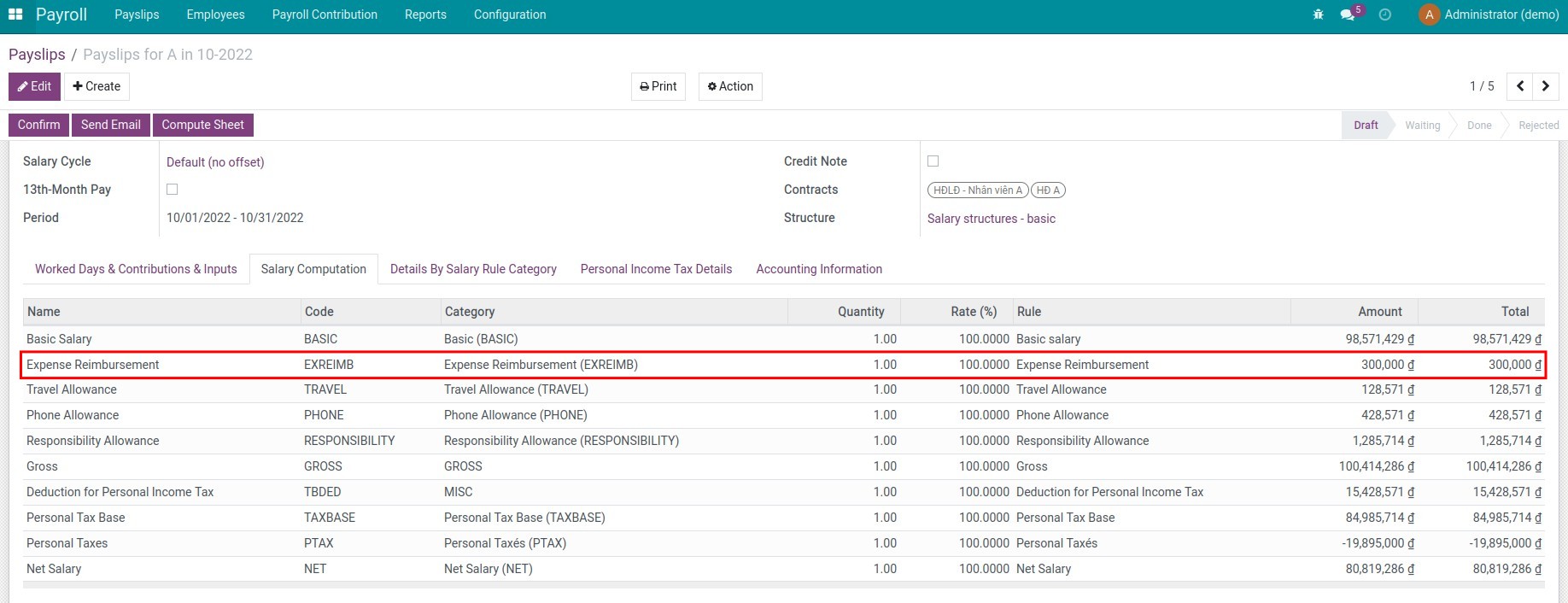

- Add the salary rule HR Expense Reimbursement Amount to calculate the amount to be reimbursed to an employee during a salary cycle. You can adjust this salary rule appropriately:

- Example: result = sum(payslip.hr_expense_ids.filtered(lambda exp: 'Air Ticket' in exp.product_id.name).mapped(total_amount)) will summarize all the expenses amount concerning 'Air Ticket' and return the result for the salary rule.

- Etc.

- Allows to identify information about expenses and automatically calculate the amount to be reimbursed to employees on payslips.

Business Value

- Streamlined Reimbursement Process: Simplifies the management of employee expense reimbursement by integrating it directly into the payroll process.

- Accuracy and Transparency: Ensures that expense reimbursement amounts are accurately calculated and clearly documented in employee payslips.

- Time-saving: Reduces administrative workload by automating the transfer of approved expense data to payroll for reimbursement.

- Policy Compliance: Ensures alignment with company reimbursement policies by enabling configurable salary rules for expense categories.

- Financial Insights: Provides a unified view of expense reimbursements and salary payments, facilitating better financial management and planning.

Who Should Use This Module

This module is ideal for:

- Companies managing frequent employee expenses requiring streamlined reimbursement processes.

- HR and payroll teams seeking to integrate expense management with salary calculations efficiently.

- Organizations looking to maintain transparency and accuracy in reimbursing employee expenses.

- Businesses wanting to align expense reimbursement with payroll policies to minimize manual errors.

- Enterprises seeking to optimize time and resource utilization in handling expense-related payroll adjustments.

Editions Supported

- Community Edition

Installation

- Navigate to Apps;

- Search with keyword to_hr_expense_payroll;

- Press Install.

Instruction

Instruction video: HR Expense & Payroll Integration

1. Employee proposes reimbursement for expenses in payslip

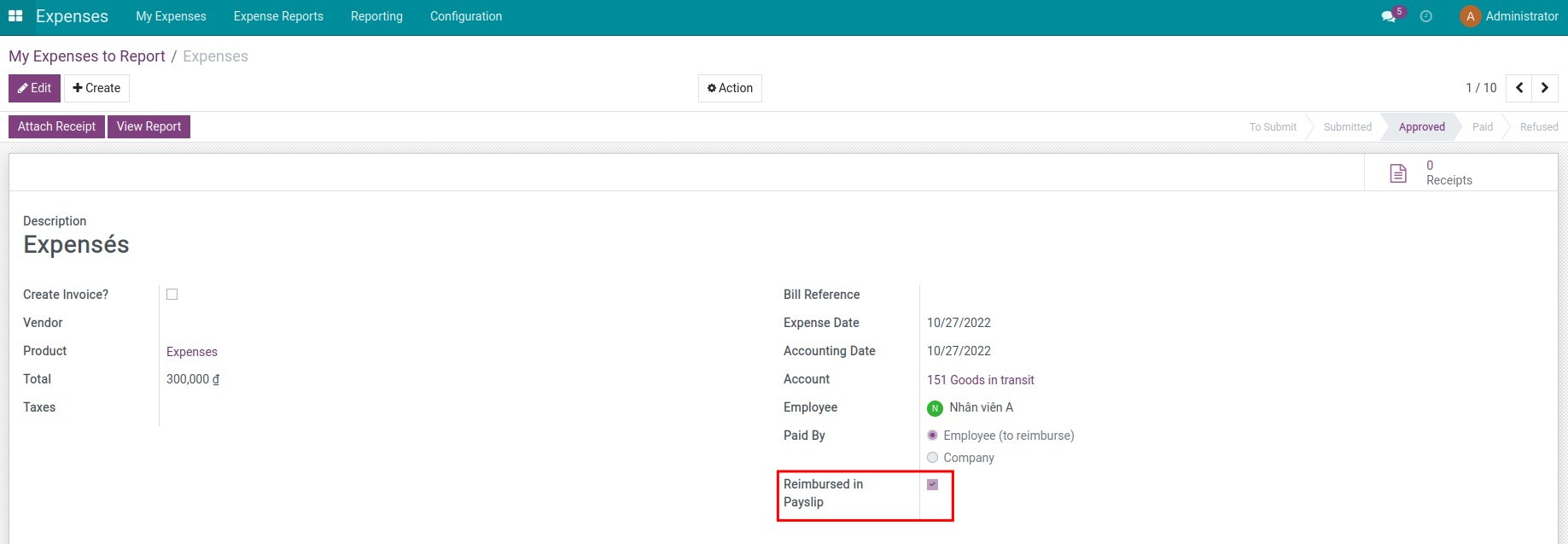

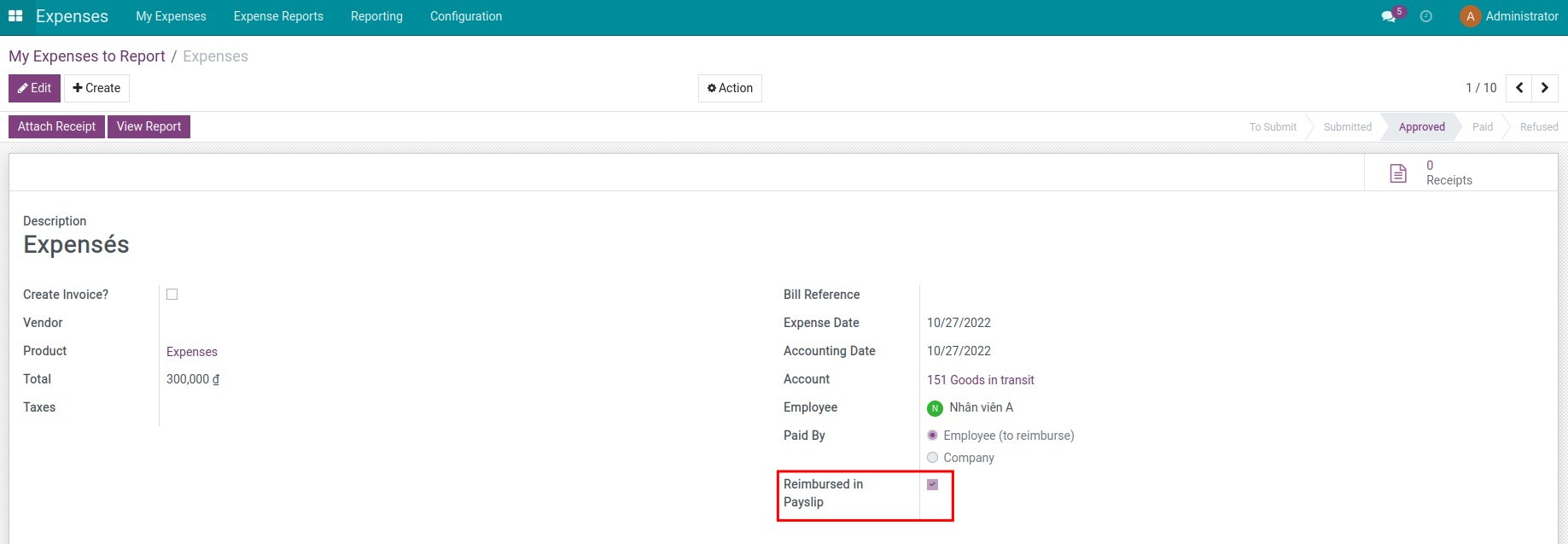

Go to Expenses ‣ My Expenses ‣ My Expenses to Report to create and submit to the manager to approve your expenses that have been paid. Then, you need to check Reimbursed in Payslip on the expenses:

See more instructions at Create expenses by employees.

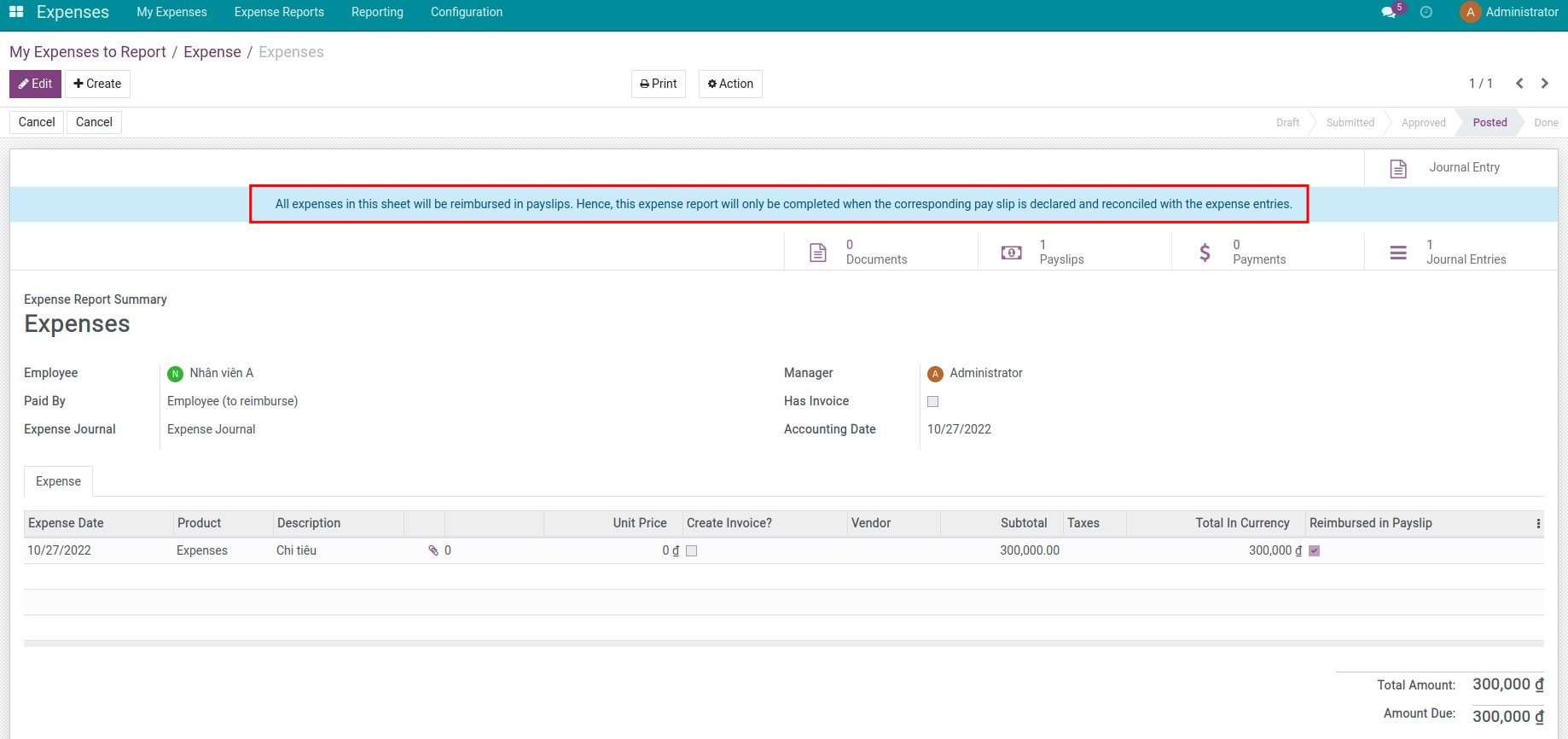

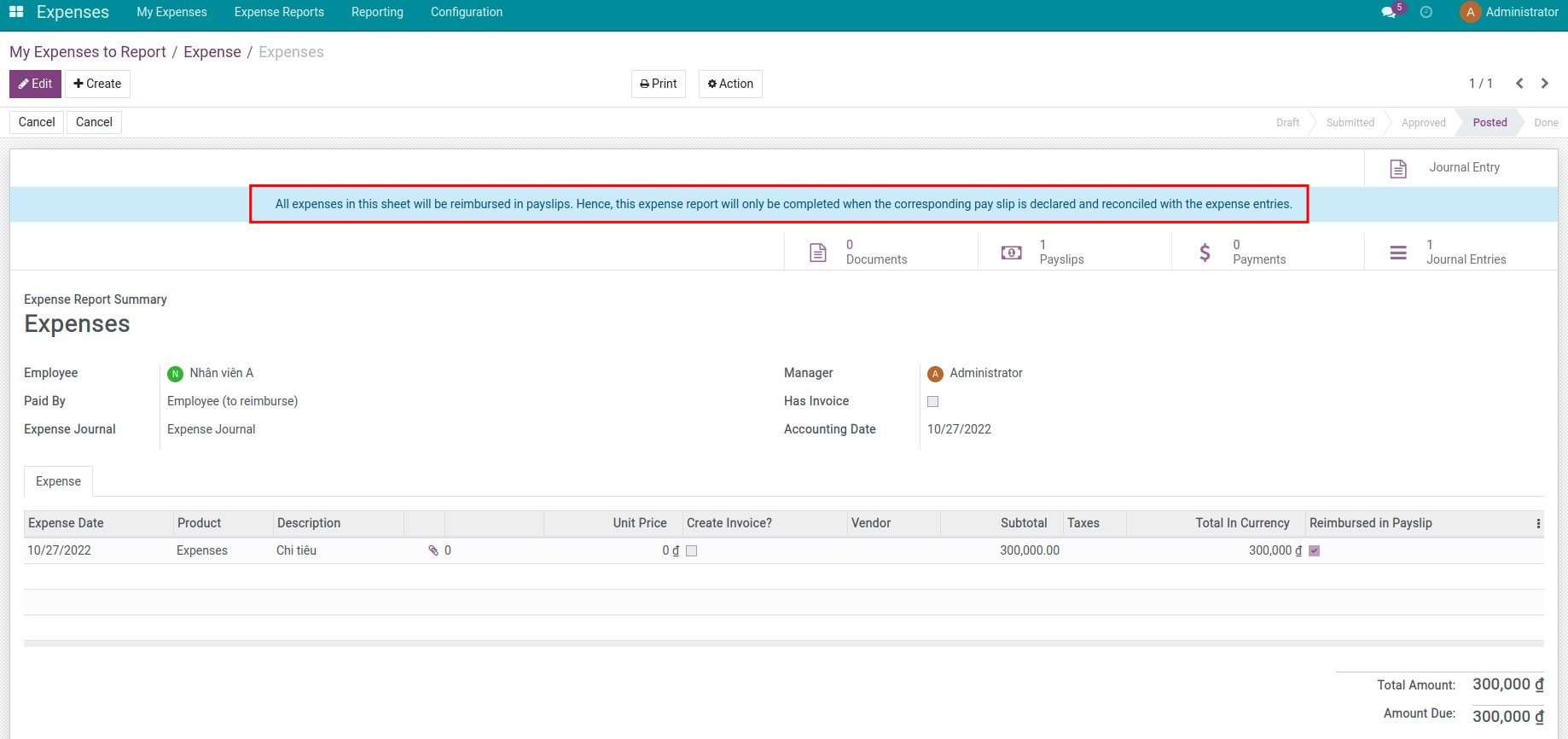

After the manager approves the expenses and the accountant posts the expense report, you will see the message All expenses in this sheet will be reimbursed in payslips. Hence, this expense report will only be completed when the corresponding pay slip declared and reconciled with the expense entries on the expense report.

2. Calculate the amount to be reimbursed to the employee

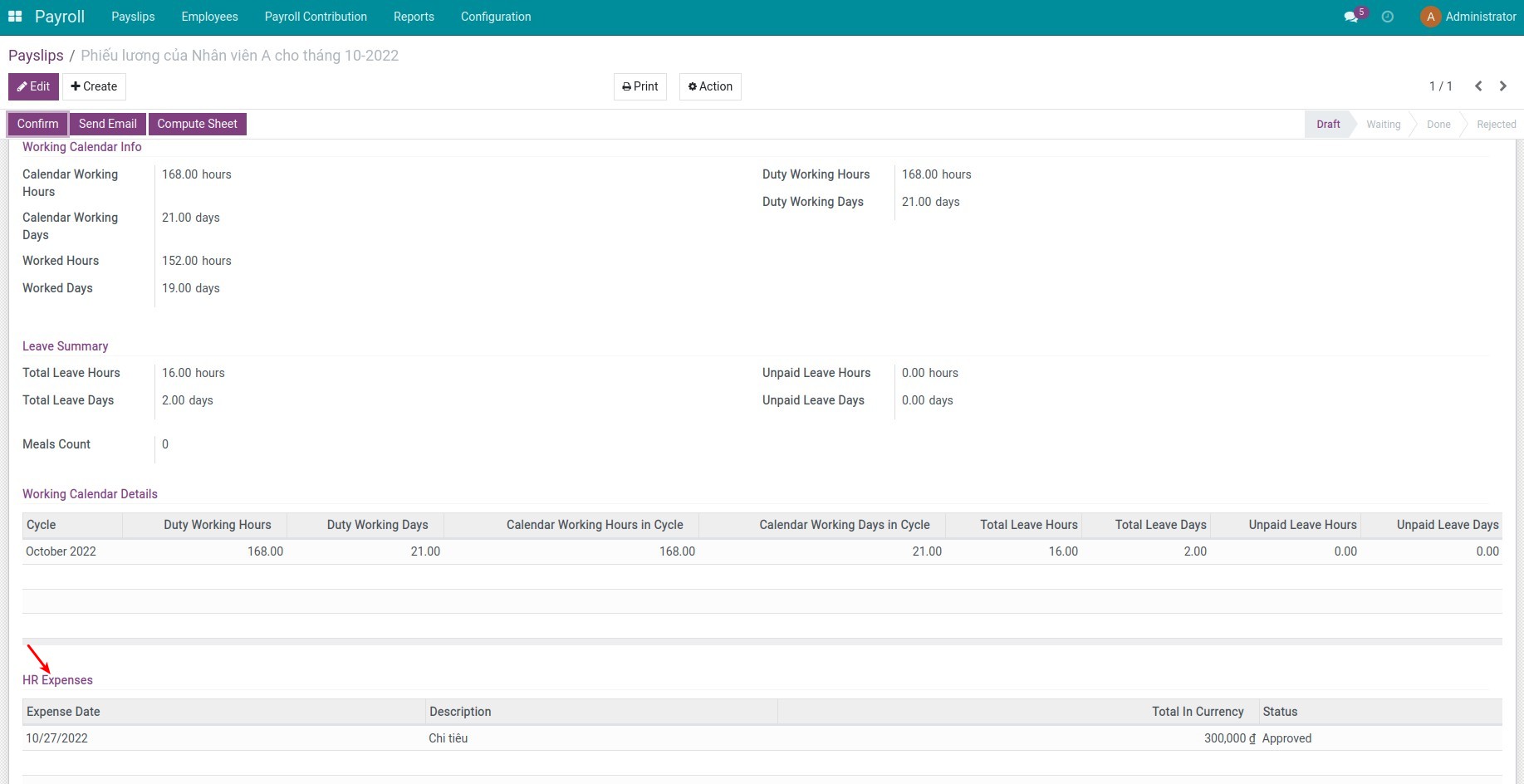

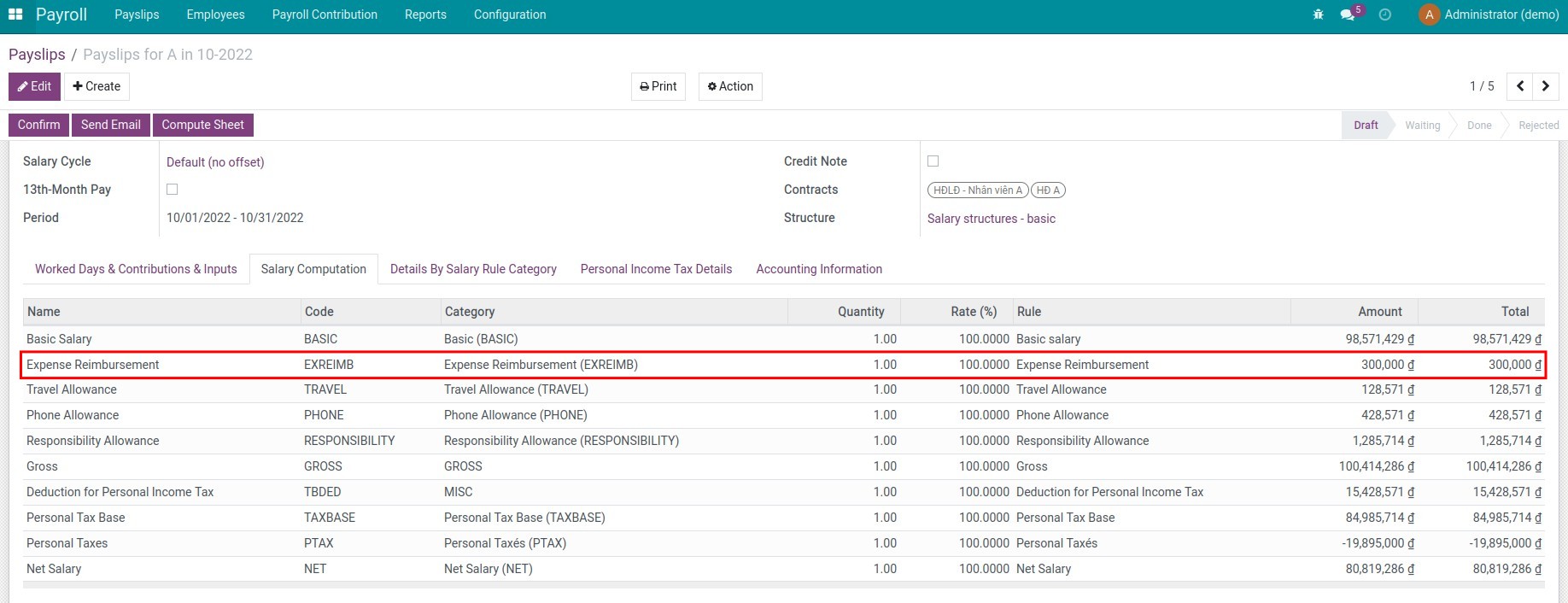

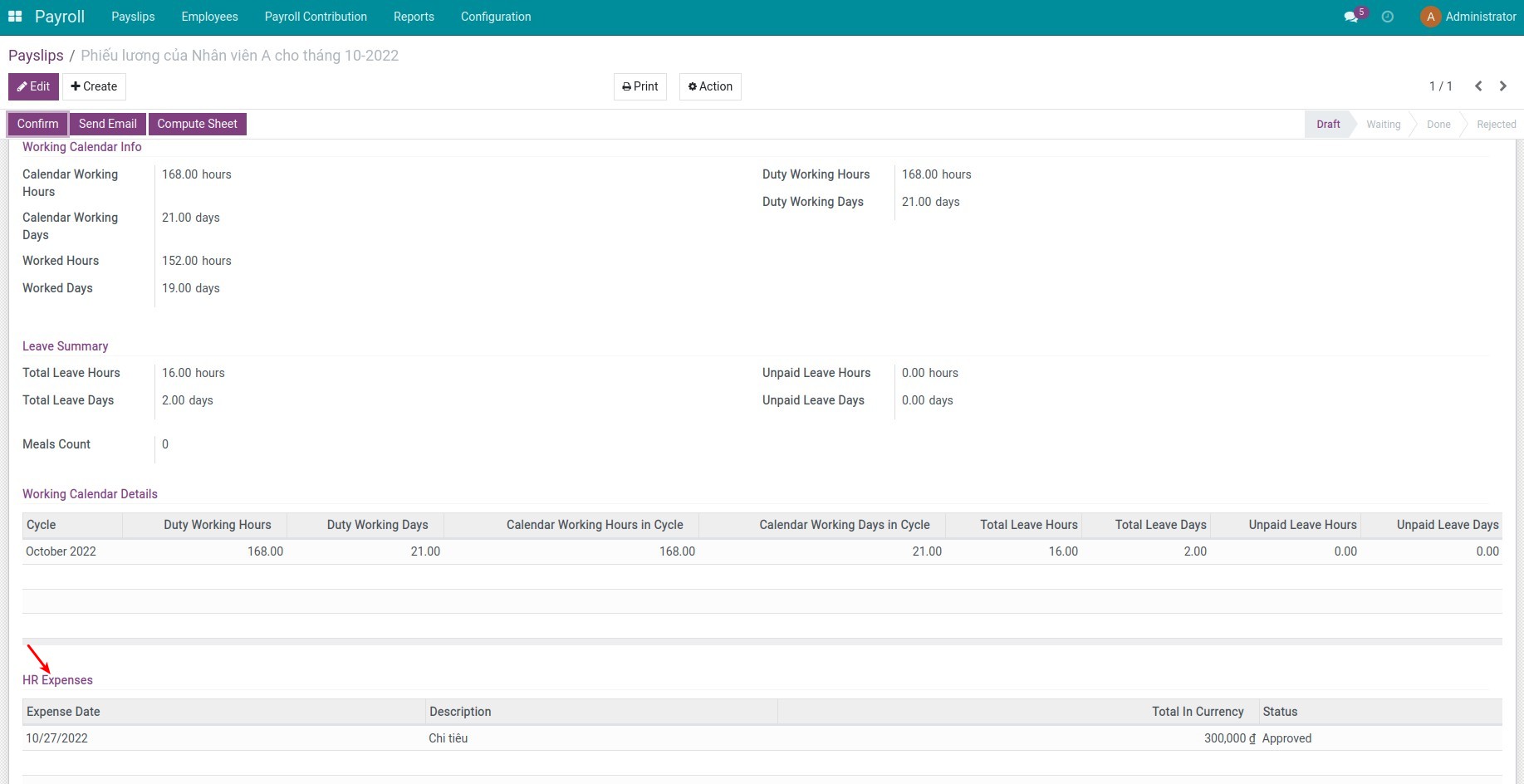

Go to Payroll ‣ Payslips ‣ Payslips to create a new payslip for an employee, press Compute Sheet, then you will see:

- Details of employee expenses during the salary cycle.

- The amount to be reimbursed to the employee is automatically calculated on the payslip based on the salary rule.

This software and associated files (the "Software") may only be

used

(executed, modified, executed after modifications) if you have

purchased a

valid license from the authors, typically via Odoo Apps,

or if you

have

received a written agreement from the authors of the

Software (see the

COPYRIGHT file).

You may develop Odoo modules that use the Software as a library

(typically

by depending on it, importing it and using its

resources), but

without

copying any source code or material from the

Software. You may distribute

those modules under the license of your

choice, provided that this

license

is compatible with the terms of

the Odoo Proprietary License (For

example:

LGPL, MIT, or proprietary

licenses similar to this one).

It is forbidden to publish, distribute, sublicense, or sell

copies of the

Software or modified copies of the Software.

The above copyright notice and this permission notice must be

included in

all copies or substantial portions of the Software.

THE SOFTWARE IS PROVIDED "AS IS", WITHOUT WARRANTY OF ANY KIND,

EXPRESS OR

IMPLIED, INCLUDING BUT NOT LIMITED TO THE WARRANTIES OF

MERCHANTABILITY,

FITNESS FOR A PARTICULAR PURPOSE AND

NONINFRINGEMENT. IN NO EVENT

SHALL THE

AUTHORS OR COPYRIGHT HOLDERS

BE LIABLE FOR ANY CLAIM, DAMAGES OR OTHER

LIABILITY, WHETHER IN AN

ACTION OF CONTRACT, TORT OR OTHERWISE,

ARISING

FROM, OUT OF OR IN

CONNECTION WITH THE SOFTWARE OR THE USE OR OTHER

DEALINGS IN THE

SOFTWARE.