Demo video: Payroll By Administrative Regions

Key Features

- Allow to declare the minimum wage by Administrative region;

- Allow to declare the minimum/maximum contribution base, the maximum contribution value of employees and company by Administrative region for contributions deducted from salary such as social insurance, unemployment insurance, v.v.

- Based on the above declarations, the Payroll app will automatically calculate and identify the actual contribution levels that apply to each employee contract.

Business Value

- Compliance Made Easy: Automatically applies regional rules for minimum wages and contributions, ensuring adherence to local labor laws.

- Error Reduction: Eliminates manual adjustments, minimizing errors in payroll calculations and reporting.

- Customizable for Regional Differences: Adapts seamlessly to multiple administrative regions with varying regulations.

- Operational Efficiency: Simplifies payroll workflows by directly integrating regional rules into the calculation process.

- Financial Transparency: Provides clear insights into payroll contributions and costs by region, empowering better decision-making and resource allocation.

Who Should Use This Module

This module is perfect for:

- Multi-Region Enterprises: Businesses operating in multiple administrative regions with diverse labor and wage requirements.

- HR and Payroll Teams: Organizations looking to automate payroll compliance with regional wage and contribution rules.

- Compliance-Focused Companies: Firms aiming to minimize regulatory risks by adhering to local labor laws.

- Data-Driven Decision Makers: Companies requiring detailed analysis and management of payroll costs and contributions by region.

- Growing Organizations: Enterprises expanding into new regions needing scalable and adaptable payroll solutions.

Supported Editions

- Community Edition

Installation

- Navigate to Apps.

- Search with keyword viin_hr_payroll_administrative_region.

- Press Install.

Instruction

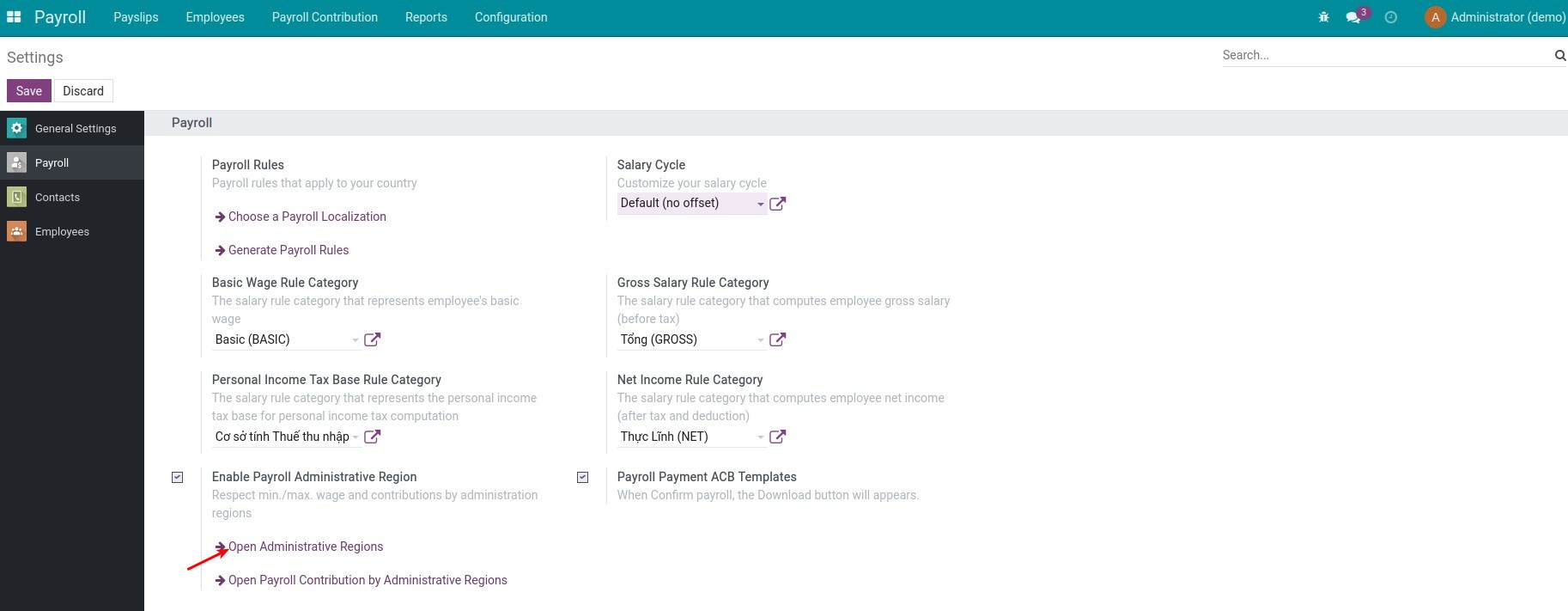

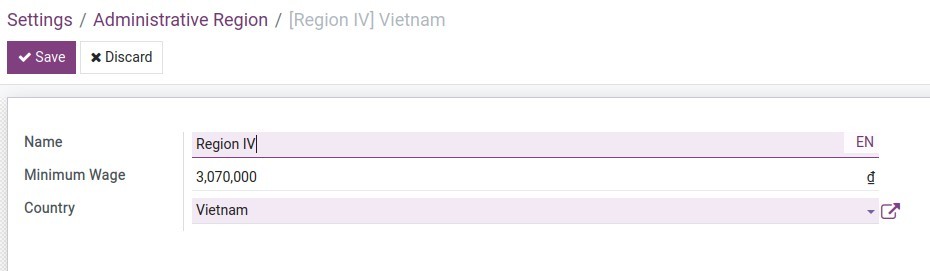

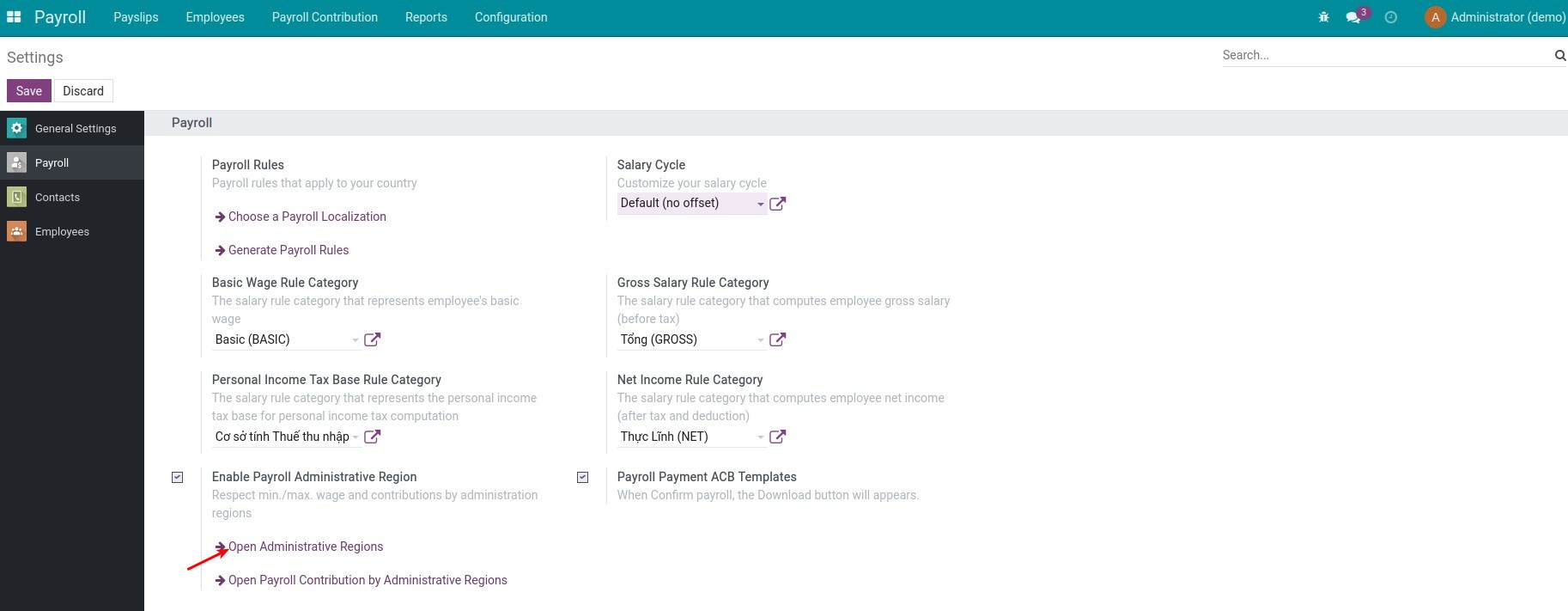

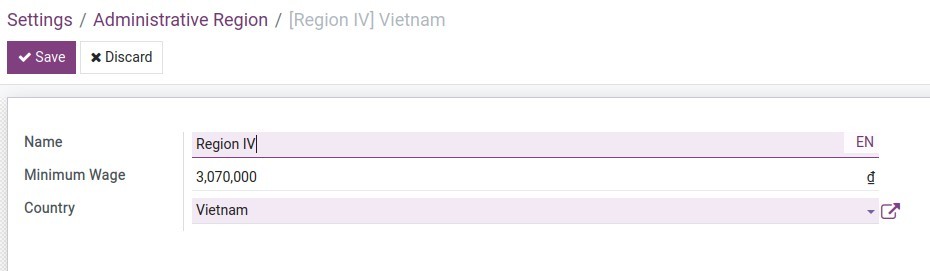

1. Setting the minimum wage by Administrative region

Navigate to Payroll ‣ Configuration ‣ Settings, choose Open Administrative Regions, then press Create to create Administrative regions and set the corresponding minimum wage:

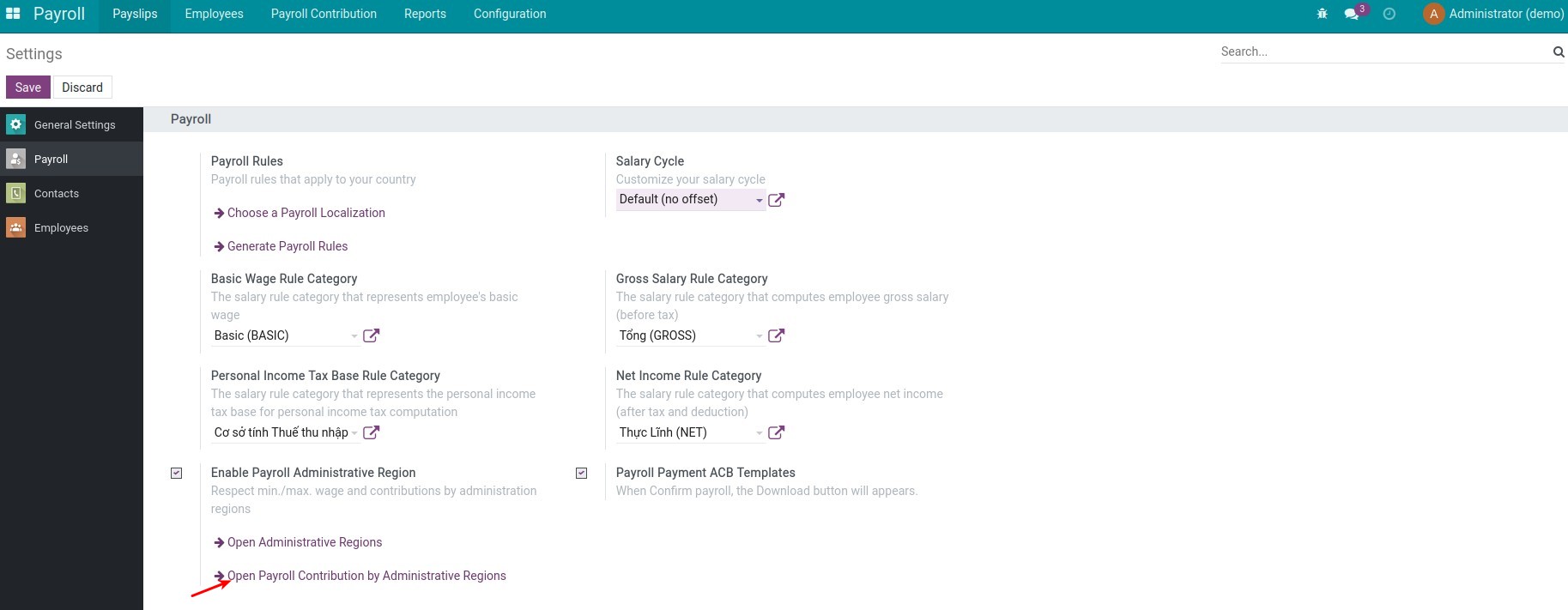

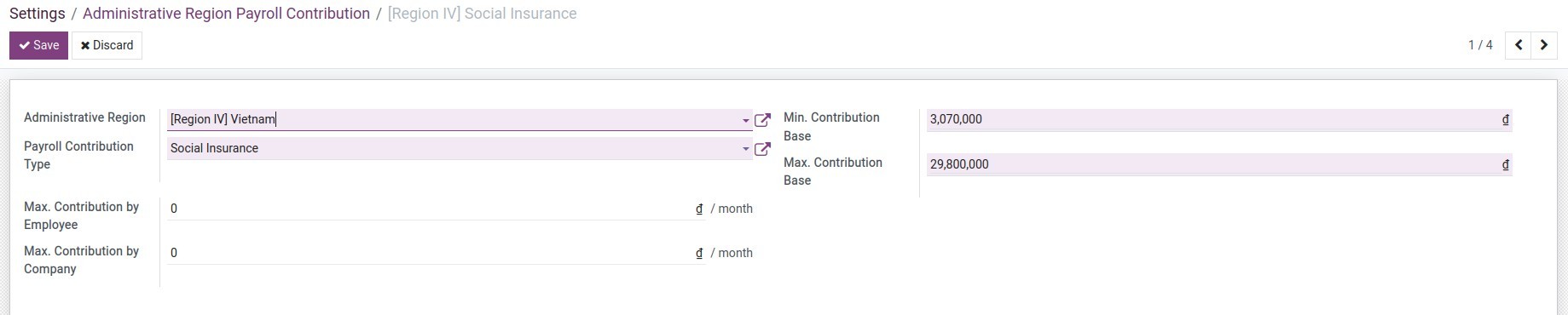

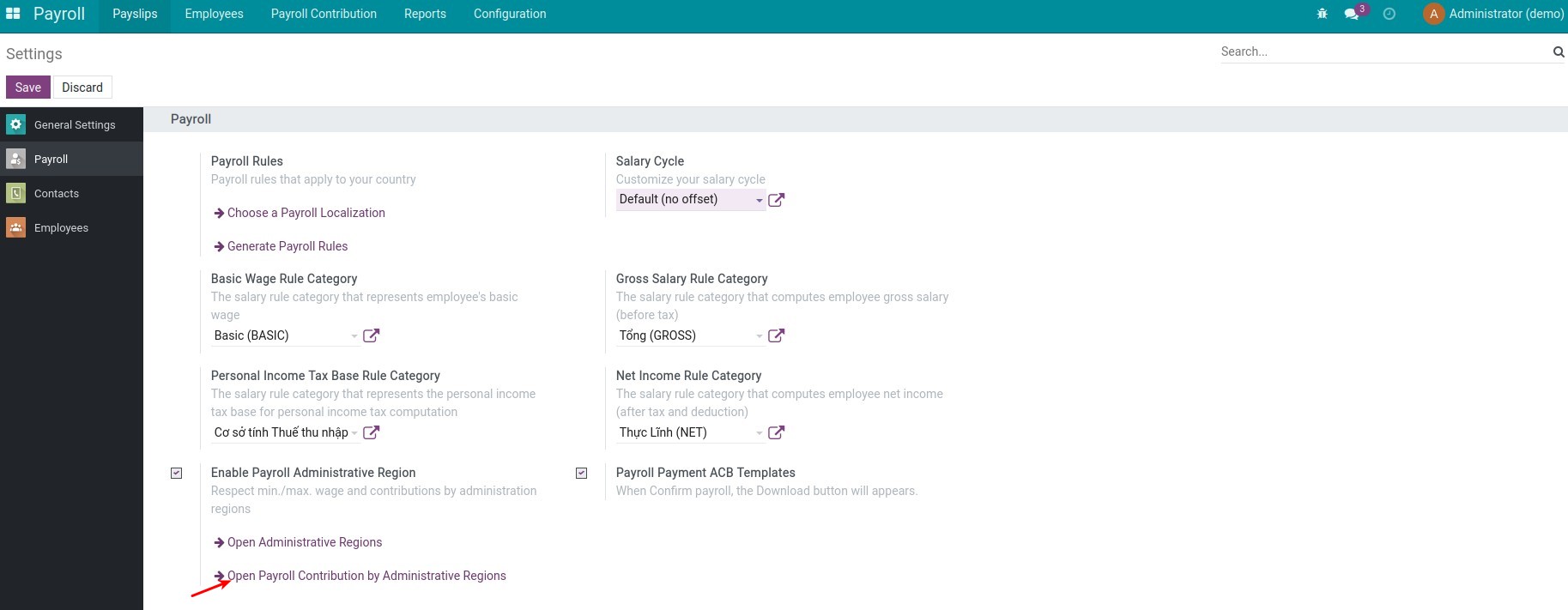

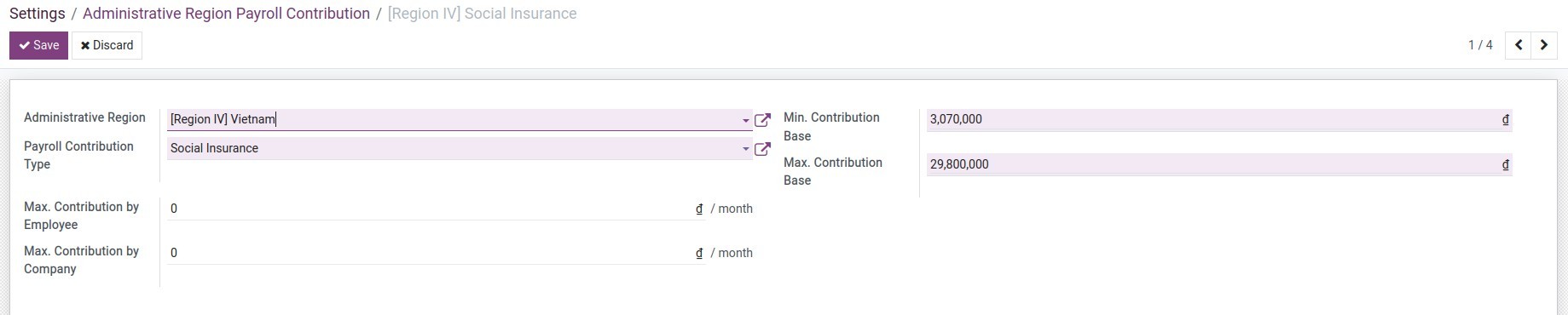

2. Setting the min/max contribution base

Navigate to Payroll ‣ Configuration ‣ Settings, choose Open Payroll Contribution by Administrative to create the Administrative region payroll contribution:

Setting the contribution bases:

- Min. Contribution Base: Minimum level as a basis for calculating contributions. If the computation base is lower than the minimum, contributions will be calculated based on the minimum.

- Max. Contribution Base: Maximum level as a basis for calculating salary contributions. If the computation base is higher than the maximum, contributions will be calculated based on the maximum.

- Max. Contribution by Employee: Contribution deduction from the maximum salary that employees have to pay. If the calculated employee contribution is higher than this, the actual contribution deduction will be equal to this maximum contribution. Set to 0 if not specified.

- Max. Contribution by Company: Contribution deduction from the maximum salary that the company has to pay. If the calculated company contribution is higher than this, the actual contribution deduction will be equal to this maximum contribution. Set to 0 if not specified.

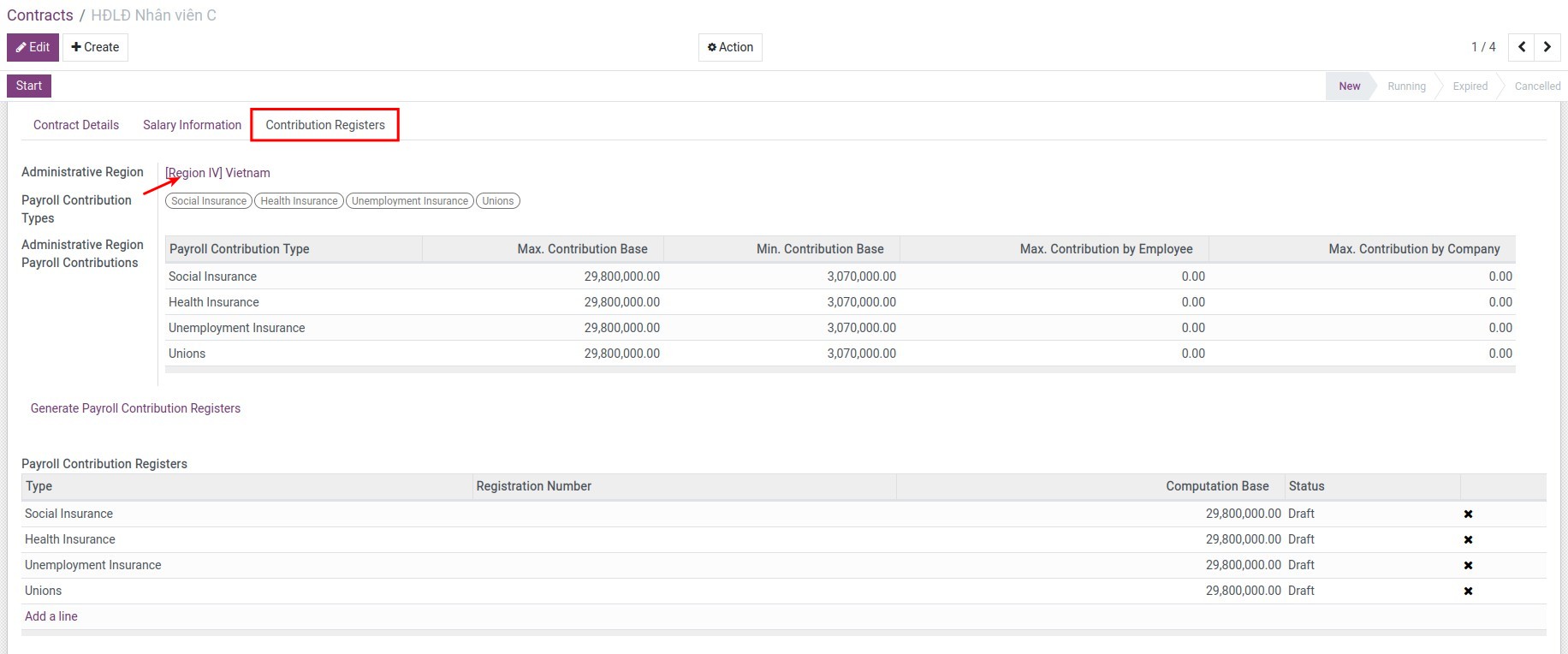

3. Apply to the employee contracts

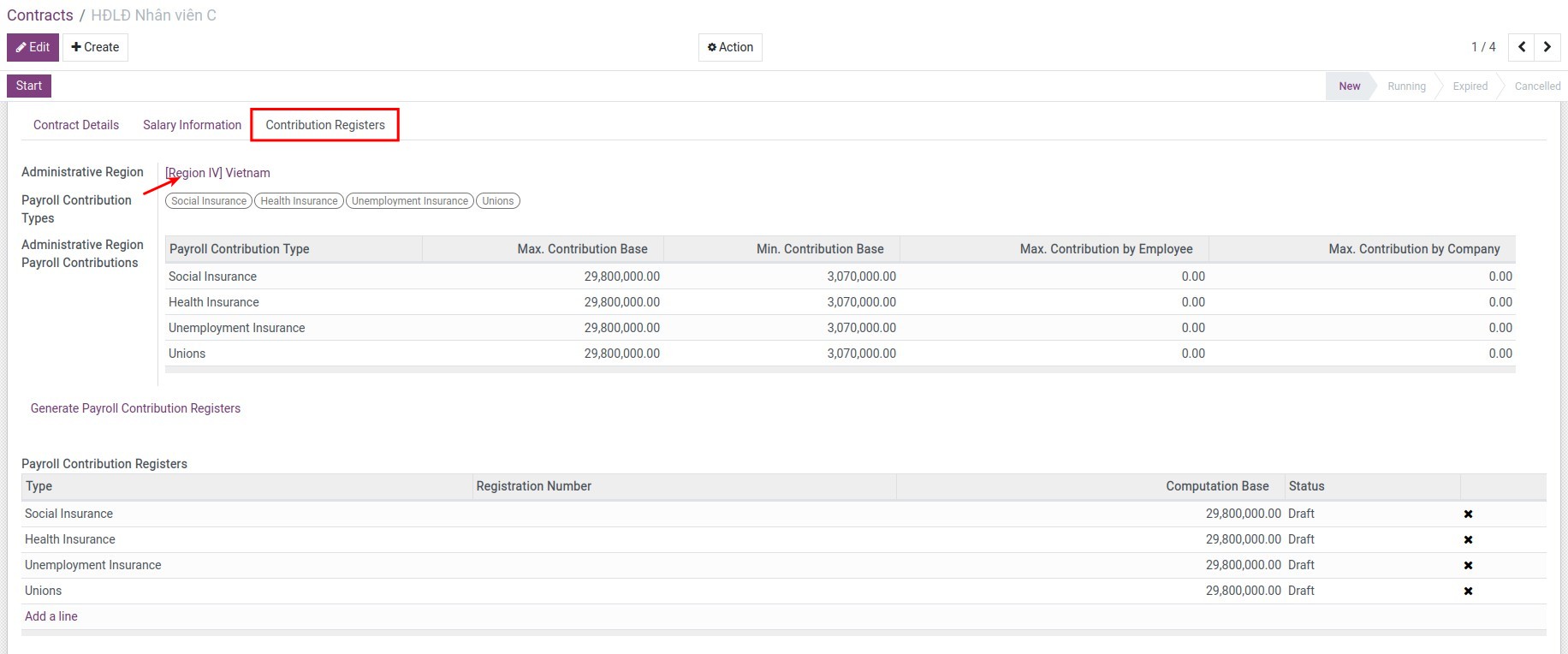

Navigate to Payroll ‣ Employees ‣ Contracts to select an existing contract or create a new one. At the Contribution Registers tab, select the corresponding Administrative region for the employee, then select Payroll contribution types:

This software and associated files (the "Software") may only be

used

(executed, modified, executed after modifications) if you have

purchased a

valid license from the authors, typically via Odoo Apps,

or if you

have

received a written agreement from the authors of the

Software (see the

COPYRIGHT file).

You may develop Odoo modules that use the Software as a library

(typically

by depending on it, importing it and using its

resources), but

without

copying any source code or material from the

Software. You may distribute

those modules under the license of your

choice, provided that this

license

is compatible with the terms of

the Odoo Proprietary License (For

example:

LGPL, MIT, or proprietary

licenses similar to this one).

It is forbidden to publish, distribute, sublicense, or sell

copies of the

Software or modified copies of the Software.

The above copyright notice and this permission notice must be

included in

all copies or substantial portions of the Software.

THE SOFTWARE IS PROVIDED "AS IS", WITHOUT WARRANTY OF ANY KIND,

EXPRESS OR

IMPLIED, INCLUDING BUT NOT LIMITED TO THE WARRANTIES OF

MERCHANTABILITY,

FITNESS FOR A PARTICULAR PURPOSE AND

NONINFRINGEMENT. IN NO EVENT

SHALL THE

AUTHORS OR COPYRIGHT HOLDERS

BE LIABLE FOR ANY CLAIM, DAMAGES OR OTHER

LIABILITY, WHETHER IN AN

ACTION OF CONTRACT, TORT OR OTHERWISE,

ARISING

FROM, OUT OF OR IN

CONNECTION WITH THE SOFTWARE OR THE USE OR OTHER

DEALINGS IN THE

SOFTWARE.